There has been a significant push towards transitioning to cleaner and renewable energy sources, moving away from fossil fuels due to their environmental impact. By looking at the past, the present and the future, the question remains: can we realistically achieve a complete phase-out of fossil fuels?

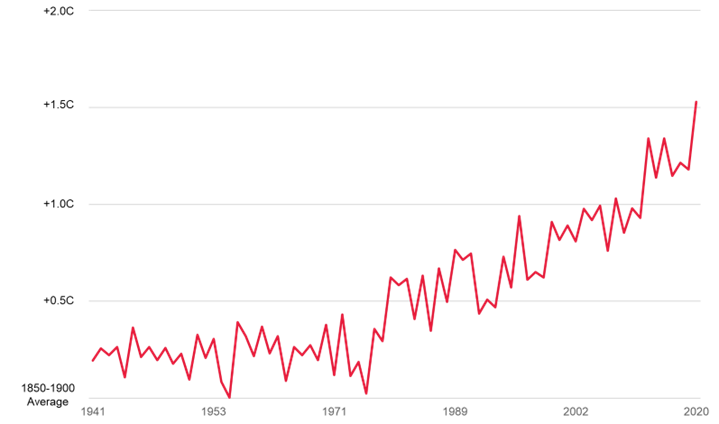

Why is the energy transition important? This chart illustrates for the first time, global warming has exceeded the critical threshold of 1.5°C across an entire year from February 2023 to January 2024. Even though the world has not yet permanently breached the 1.5°C threshold target outlined in the 2015 Paris climate agreement, which is measured over decades, this emphasises the urgency of expediting the energy transition.

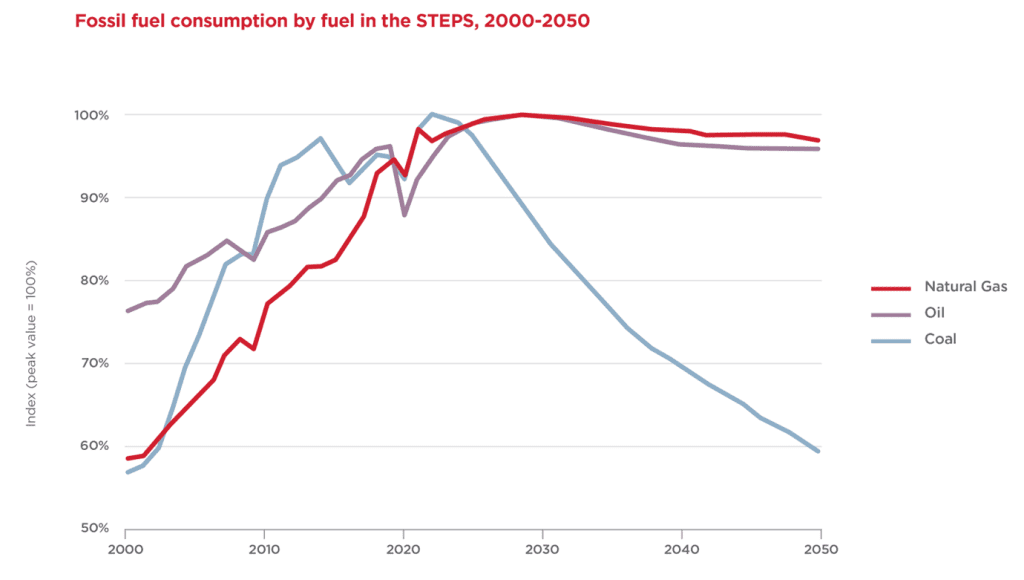

Despite the urgent need for a clean energy transition, the consumption of all three fossil fuels is projected to increase and peak by 2030, based on current government policy under the Stated Policies Scenarios (“STEPS”). Although global coal demand is expected to decline sharply after the peak, natural gas and crude oil, with relatively lower carbon emissions, are forecasted to decline more gradually. However, these projected declines are inconsistent with the requirements of the Net Zero Emissions (“NZE”) scenario.

In this briefing, we will focus on natural gas, which has cleaner combustion compared to coal and oil. Natural gas emits about 50% less carbon dioxide when burned than coal and is expected to remain a key component in the energy mix for decades, even amid ongoing efforts towards green transition.

The growth seen in natural gas consumption is matched by a substantial upward trend in production since 2000, almost doubling from 2010 to the present, with the US taking the lead, followed by Russia.

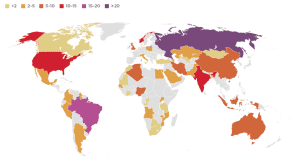

Natural gas production is expected to keep increasing as many countries are still actively developing new gas fields. This chart shows 47 countries with approved plans for new oil and gas fields, that have received final investment decisions for development. Currently, Russia has the largest gas reserve, followed by Iran, Qatar and the US.

In addition to the approved new gas fields, there has been significant recent news about new gas discoveries worldwide in locations such as Turkey, Indonesia, Morocco, Bangladesh and more.

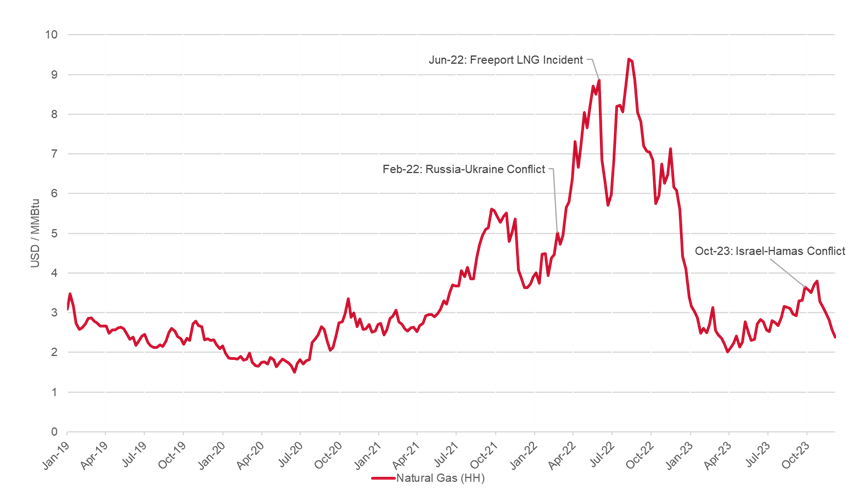

In recent years, natural gas prices were on a downward trend prior to the pandemic and the trend continued with a further decline due to the pullback in economic activity in 2020. We then saw the strong recovery of the global economy and prices increased well above the pre-pandemic level in 2021.

This briefing will highlight three recent significant events in the natural gas market: the Russia-Ukraine conflict in February 2022, the Freeport LNG incident in June 2022 and the Israel-Hamas conflict in October 2023.

Russia-Ukraine Conflict

Just prior to the conflict, the EU’s reliance on natural gas imports from Russia was substantial, accounting for approximately 40%. Similarly, Russia exported most of its natural gas to the EU, demonstrating a mutual economic reliance between the two regions at the time.

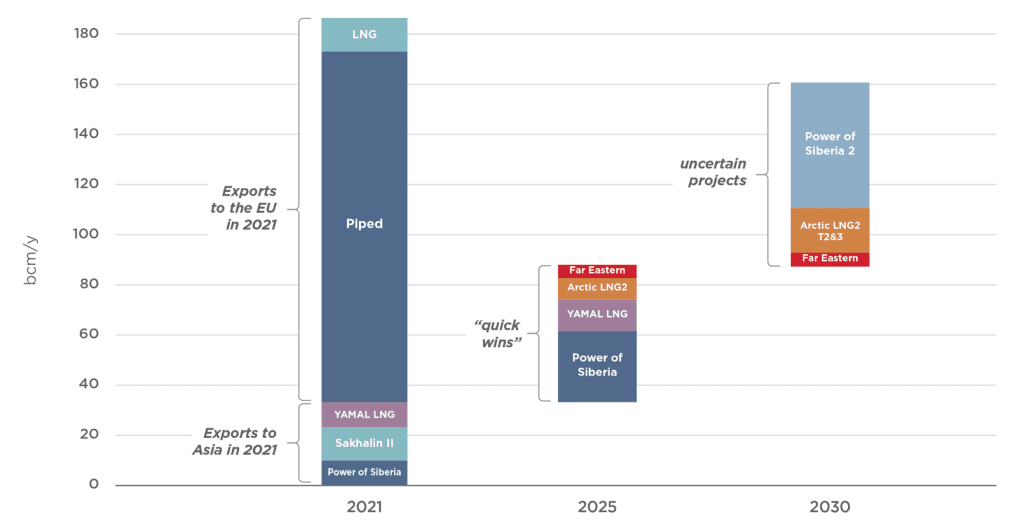

To achieve quick wins by 2025, Russia aims to divert more LNG to Asia and to increase gas supply to China via the existing Power of Siberia pipeline. Russia recently announced a new daily record in gas pipeline exports to China, and the total gas export in 2023 was nearly 1.5 times higher than shipments in 2022, slightly exceeding contractual obligations. Projected capacity by 2025 is anticipated to be almost five-fold compared to the export volumes of 2023.

There are a few uncertain projects currently ‘in the pipeline’, the main one being the Power of Siberia 2 pipeline, which would establish gas connections between Western Russia (previously designated for European export) and China. While the two countries are finalising agreements, no supply contract has been signed yet. In the best-case scenario, the Power of Siberia 2 might commence operation after 2030 as the construction would require at least 5 years. This pipeline has the potential to position China as Russia’s main gas importer.

Nonetheless, even with multiple projects scheduled to be operational by 2030, it appears unlikely that Russian gas supplies to Asia will match the levels supplied to the EU during 2021.

Global conflicts and NZE initiatives have had a significant impact and will continue to have a future impact on natural gas and liquified natural gas (LNG) markets, which likely will be the last fossil fuel to be phased out to meet NZE goals. In response to the conflict in Ukraine, the EU is managing the demand for natural gas usage and, at least in the short term, has decreased natural gas consumption by 18% from August 2022 to March 2023, compared with the same period in recent years.

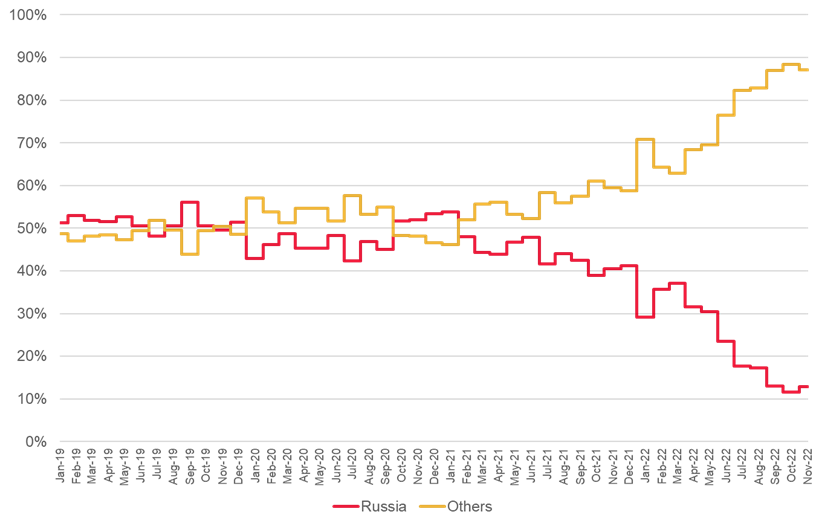

Europe has also drastically reduced gas imports from Russia that were received via pipeline, from the pre-invasion rate of 50% to about 10% in 2022, as shown below.

Our research shows that the EU import of natural gas from Russia has dropped a further 50% in 2023, so the total natural gas received from Russia is now only about 5%. Of interest, the EU has not changed the amount of LNG it receives from Russia, although it represents a small percentage of total gas demand. Whilst the EU has increased imports of natural gas from other pipelines in the North and Caspean Sea, as well as Eastern Europe, it has not been enough to replace the gas previously provided by Russia.

The EU has turned to LNG imports to fulfil the remaining demand for gas, mainly from the US. There has been a notable shift in the market, with an increasing volume of Russian gas being directed towards China, which results in a decrease in LNG imports in Asia and a substantial increase in LNG supply flowing towards the EU instead.

LNG is in a liquid-like state, which takes up only 1/600th of the original gas volume. However, there is a significant capital cost involved to produce and transport LNG, to store it and for its regasification at the receiving terminals. The various cost components of LNG are listed below.

- 11% exploration and production;

- 42% refrigeration and liquefaction;

- 20% transportation; and

- 27% storage and regasification

As noted above, following the Russia-Ukraine conflict, the EU’s gas balance has shifted from the Russian pipeline to global LNG supplies, mainly from the US. However, the situation got more complicated with the Freeport LNG incident in June 2022.

Freeport LNG Incident

The Freeport LNG export facility, handling 15 million tonnes per annum (around 20% of U.S. LNG exports), is one of the largest in the world and the second largest in the United States.

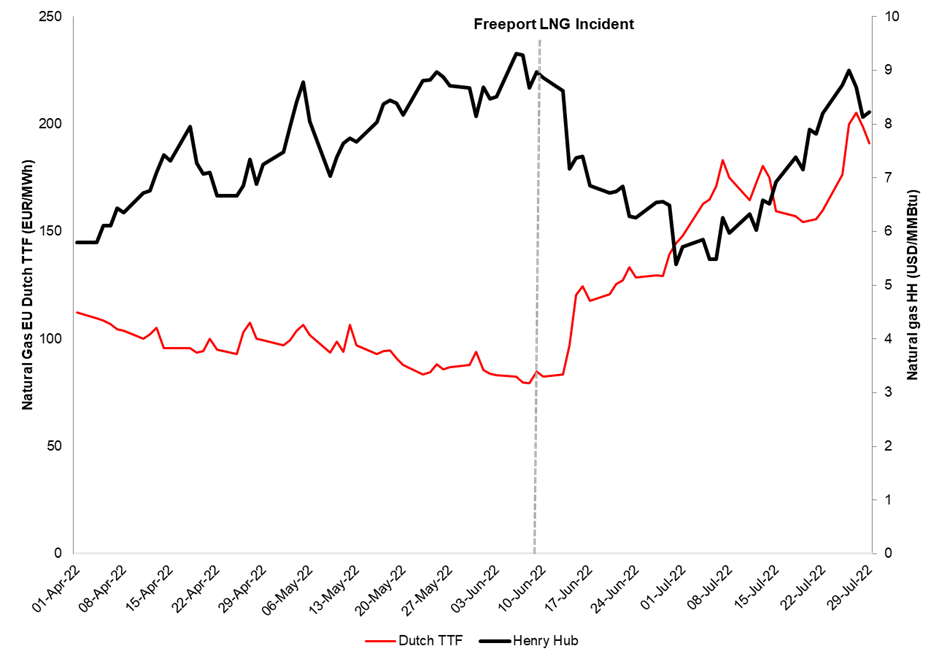

Significant disruption occurred on June 8, 2022, when an explosion affected the Freeport LNG liquefaction plant in Texas. With Freeport LNG exports being suspended from June 2022 to February 2023, this marked a pivotal moment in the history of US natural gas exports that showcased the deepening connection between US gas supply and global gas markets.

The timing of the shutdown coincided with a period of heightened global demand for LNG as many nations sought alternatives to reduce their reliance on Russian gas. With U.S. LNG exports experiencing a notable surge, a significant portion of Freeport LNG’s exports were directed towards Europe.

The aftermath of the incident had far-reaching consequences, contributing to a surge in LNG prices due to a supply shortage in the market. Conversely, the incident had a profound impact on U.S. LNG exports, leading to a redirection of more natural gas into storage. The resulting surplus of natural gas in the U.S. market caused a decline in domestic natural gas prices, as the Freeport LNG terminal, a major gas buyer, ceased its purchasing activities.

Israel-Hamas conflict

While the global energy market was still readjusting to the aftermath of the Russian-Ukraine conflict, an escalation in geopolitical tensions in the Middle East has kept the markets on edge since 7 October 2023.

As the escalation of the conflict raised safety concerns, Israel shut down the production at its giant Tamar gas field off its southern coast. European natural gas prices rose more than 50% in a month, hitting an eight-month high of €56 per megawatt-hour, amid concerns that a wider conflict in the Middle East could disrupt gas supplies. However, the impact on gas markets was limited and temporary. After a large spike, the prices retreated and reached pre-conflict levels, as can be seen in the chart below.

Global events such as these show how volatile prices can become in a very short time period. With such price volatility, forecasting prices becomes challenging, making it difficult to set loss reserves accurately from the outset. Also, sums insured which are often set months before policy inception might be understated or overstated due to this fluctuation.

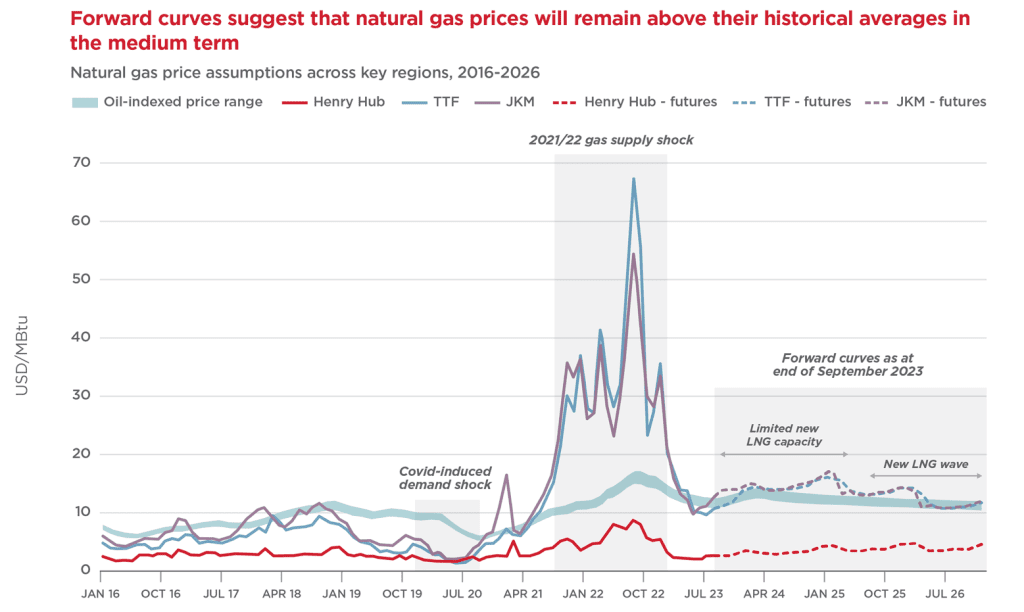

According to the International Energy Agency (IEA), forward-looking projections of gas prices are expected to remain fairly stable into the mid-term future and show a stabilisation through 2026 as a new wave of LNG liquification and regasification plants are planned to come online beginning in 2025. It’s important to note that projections inherently carry uncertainty, as the future is unpredictable. This projection was formulated before July 2023 and did not account for events such as the Israel-Hamas conflict in October 2023. We shall wait and see how gas prices evolve in the future.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

Graph 1 – https://www.bbc.com/news/science-environment-68110310

Graph 4 – https://www.tradingeconomics.com

Graph 5 – https://globallnghub.com/how-quickly-can-russia-divert-its-gas-supplies-from-europe-to-asia.html

Graph 6 – https://www.consilium.europa.eu/en/infographics/eu-gas-supply/

Graph 7 – https://www.tradingeconomics.com

Graph 8 – https://www.tradingeconomics.com