Cyclone Gabrielle made history as the costliest tropical cyclone in the southern hemisphere.

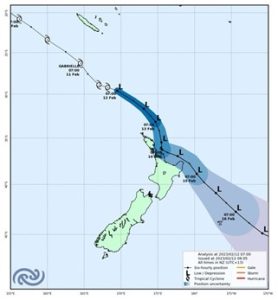

Conceived as a tropical low North of Fiji in early February 2023, Cyclone Gabrielle intensified to as high as Category 3 storm. After downgrading to ex-tropical cyclone status on 12 February 2023, Gabrielle reached the Northern regions of New Zealand’s North Island by 13 February 2023. Gabrielle continued Southeast thereafter, reaching the Eastern coast of the North Island by 14 February 2023.

Over the course of 12 February to 14 February 2023, the northern and eastern regions of the North Island sustained the most severe flooding, damage, and loss of life as a result of the Cyclone with isolated areas in the Coromandel, Hawkes Bay, and Gisborne regions recording more than 400 mm of rain.

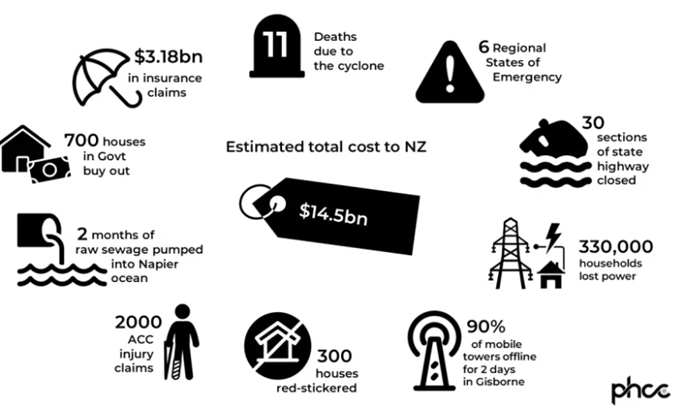

The extensive damage to communities and infrastructure across the North Island prompted New Zealand to declare a national state of emergency for only the third time in its history on 14 February 2023.

The year prior to Cyclone Gabrielle, most regions on the North Island measured record-breaking rainfall through 2022, which was driven by more frequent weather systems during a La Nina periodic season.

The month prior to Cyclone Gabrielle, rainfall approximately 8.5 times greater than the national average was recorded during January 2023. Auckland, New Zealand’s most populated region, saw its wettest January since records began and experienced an extreme rainfall event known as the ‘Auckland Floods’.

This exacerbated flooding on the North Island, with already sodden ground and swollen rivers. A number of rivers burst their stopbanks, releasing torrents of floodwaters across the Hawkes Bay region, in particular, and depositing silt over horticulture and agriculture farmlands.

Cyclone Gabrielle set a world record for the largest number of landslides from one event with approximately 850,000 landslides nationwide.

Impact

Aside from physical damage to property, the Northland, Coromandel, Gisborne, and Hawkes Bay areas, in particular, suffered significant landslips and flooding, which forced the closure of critical road and rail transport routes and shipping ports in and out of these regions.

Alongside transport routes, approximately 332,000 households lost power during the cyclone. While most affected residents had their power restored within a few days, some were without power for more than two weeks.

Power outages across New Zealand led to loss of telecommunications coverage and left eftpos systems offline even after power was restored. Waste, mains, and stormwater utilities were also impacted to varying extents, typically where substations had sustained flood damage. Disruptions were prolonged in areas where significant transport route damage hindered repair crews’ access and in isolated and rural communities.

Data on housing damage classifications following cyclone impacts in 2023 – MBIE 11 January 2023

Insurance Coverage

Whilst the widespread damage caused by flooding, landslides, and silt depository impacted a significant number of communities, many businesses sustained no physical damage. Instead, they were impacted by loss of utilities, prevention of access, closure of key transport routes and ports, or all of the above.

In the absence of physical damage to Insured property, ordinary Business Interruption insurance will not respond to claimants seeking reparation for Loss of Gross Profit, Increased Cost of Working or Extra Expenses.

Many businesses, however, had Dependency or Contingency Coverage Extensions to cover their dependency on customers and suppliers, power, water, and waste utilities, as well as transport routes and ports. This presented businesses who did not sustain physical damage an opportunity to claim for Business Interruption losses directly caused by these contingent perils.

Contingent Business Interruption

Despite dependency extensions coming into effect in response to Cyclone Gabrielle, this coverage came with limitations such as time deductibles, proximity restrictions, and Sub Limit constraints.

These conditions of contingent Business Interruption, however, are nothing new to the New Zealand insurance market.

With a population density of approximately 19.53 people per square kilometre in 2023, New Zealand’s insurance market has been moulded by previous catastrophes and events, and exposure adjusted to reflect the inherently high risk of insuring isolated businesses and communities in New Zealand.

That being said, and despite its prevalence in the market prior to Gabrielle, Dependency Coverage had simply not been tested on a large scale by North Island businesses in recent times, and many businesses may not have considered these limitations in the greater context of their available Business Interruption cover because of this.

Aside from some isolated storm events which are common to the Nelson and West Coast regions of the South Island, the majority of North Island had not seen a severe weather event arguably for decades.

The common challenges in measuring losses under this cover are unpieced further below:

Time Deductibles

Time deductibles, usually between 24 and 72 hours, were often conditional to indemnification under Dependency Extensions. Losses sustained in excess of the time deductible were eligible for cover. In some cases, the time deductible, once exceeded, was also claimable.

As a result of this limitation, many claimants in less severely impacted regions such as Auckland and Coromandel achieved limited coverage periods or were unable to achieve claim acceptance with most utilities restored within time deductible periods.

With at least four North Island regions sustaining widespread damage to utilities infrastructure simultaneously, service providers’ resources were however stretched to remedy utilities damage all at once. Coupled with limited road access, in many causes this resulted in utility outages exceeding 48 hours. This was the case in isolated and rural areas of Northland, Auckland, and the Waikato but more prominent across the Gisborne and Hawkes Bay regions.

Transport Route closures comparatively extended much longer, particular SH 2, and SH 5 which remained closed for as much as five weeks. These highways connected the population of Eastern regions of Gisborne and Hawkes Bay to rest of the North Island.

SH 1 remained closed for approximately one to two weeks in Northland and the Coromandel had their critical SH 25A route closed for more than 10 months, though this damage was instigated by the Auckland Floods event before deteriorating following Gabrielle.

Claimants in proximity to these regional areas were able to outlast most time deductibles. Even so, as trade could typically recommence once power was restored and in the absence of physical damage, claimants often sustained less severe losses on an ongoing basis in contrast to the initial time deductible period.

Proximity Restrictions

Proximity restrictions, though less common became pivotal considerations particularly for dependency coverage triggered by prevention of access and the closure of transport routes and ports.

In this scenario, radius mapping of the named insured locations to nearby affected routes were required to validate the acceptance of a claim. Where the impact to transport routes was pervasive across a given route such as with SH 2 and SH 5, claimants were less affected.

Comparatively, due to the elongated landscape of the Coromandel region, claimants in the Northern areas of the Peninsula were affected by proximity restrictions more so than those in the South. This was because most extended closures of transport routes in the Coromandel occurred in the Southern sections of SH 25 and SH 25A. This proved fatal to Claim acceptance despite periods of loss exceeding any applicable time deductible.

Sub Limit Constraints

Under Dependency Coverage, Business Interruption Sub Limits were often constrained as low as 10% of the total Coverage in place.

For claimants who sustained a period of loss in excess of their applicable time deductible; satisfied applicable proximity restrictions; and had some limited ongoing impact – this cover was typically sufficient.

Comparatively, claimants under the same conditions but with extended outages or who were underinsured, their cover was exhausted rapidly and often before the business had recovered in its fullness.

Communication of this risk to claimant parties was critical and at times lost in translation, particularly in the widespread aftermath of Cyclone Gabrielle.

Causation

Identification of the proximate cause of losses stemming from Cyclone Gabrielle became a key issue.

Many businesses succumbed to extended power outages, prevention of access within the vicinity of their insured premises’, port closures, and multiple road closures simultaneously, and these likely all contributed to a sustained loss of profits in most cases.

Identifying the dominant proximate cause of losses became a challenge for Insurers and policyholders alike, and there wasn’t a single solution widely adopted by market participants.

The quality of financial information to substantiate different causes of loss, changing regional economic environment, and the changing combination of multiple causes of loss between regions (insured or uninsured or both) contributed to the absence of a one – size – fits – all approach.

New Zealand has limited passenger train infrastructure outside of Auckland City, with region travel largely restricted to the use of car transport via State Highways. Both tourists and residents rely heavily on State Highway roading infrastructure which in some cases is restricted to a single transport route such as in Hawkes Bay, Gisborne, and Northland regions with minimal to no detour contingencies available.

Most claimants had extensions to cover dependency on utilities, prevention of access, transport routes and ports, and damage to third parties available. Separating the potential uninsured causes of loss, such as loss of attraction and ongoing disruptive weather, became the integral quantification issue.

Further, where multiple insured causes of loss were sustained, the greatest of the differing time deductibles amongst contingent covers often remained applicable. With the most significant losses typically sustained in the first days following Cyclone Gabrielle, in some cases, claiming ongoing Business Interruption losses through multiple other contingent covers extended the time deductible and resultantly reduced the overall net Business Interruption loss.

Conclusion

With Cyclone Gabrielle severely impacting many different North Island regions and the majority of the population situated in these areas, New Zealand’s existing resources to manage the subsequent claims volumes were tested.

The added complexity of dealing with a large volume of dependency claims meant that Insurers had to rely very heavily on their panel of accountants to unravel the often tangled knot of multiple causation and then make sure that the correct policy limits were applied. This often included managing the expectations of the brokers and their clients.

As many of these claims were relatively low in value, efficient ways had to be found to deal with them to ensure that client expectations in both time and value delivery were met.

MDD has considerable expertise in dealing with these types of claims and the complexities that may occur in a time-efficient and cost-effective manner using its combination of local representation and regional and international depth of resources.

By Josh Herbert and David Maritz.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.