In the US property insurance market, coinsurance, an often-misunderstood concept, refers to the sharing of risk between the insured and the insurer and applies to property damage and business income loss coverage.

Coinsurance as it applies to Property Insurance

Because most property losses are partial and not total losses, the average insured will take advantage of this tendency and only insure enough to cover a partial loss. Furthermore, due to the fact that insurance is designed to spread the risk of loss according to the purchase of insurance and the payment of premiums, those insureds seeking coverage for a total loss1 end up paying a disproportionate share of premiums compared to those seeking only to insure for a partial loss. In an effort to encourage insureds to adequately insure their property and to equitably allocate premium payments, a coinsurance requirement is included in many commercial property insurance policies.

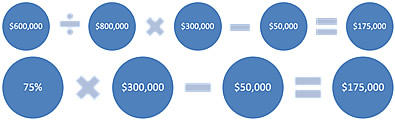

In the simplest of terms, this coinsurance requirement is often referred to as the “Has over Should Have” formula. As in:

where the “Should Have” is based on a coinsurance requirement.

The coinsurance requirement, or “Should Have” element of the formula, is typically expressed as a percentage like 80% required. In other words, the requirement is policy-mandated that the insured maintain coverage for at least 80% of the value (often replacement cost) of the property. Some insurance companies do require 90% or 100% of the value of the property to be fully insured. In blanket insurance coverage, 90% is required. If the required insurance is not carried and a loss occurs, the insured will realize a penalty (become a co-insurer or participant) for not having sufficiently insured the property.

For example, assume the following facts:

- Building replacement cost value at date of loss $1,000,000

- Coinsurance requirement per policy 80%

- Insurance maintained 3 $600,000

- Loss amount $300,000

- Deductible $50,000

In this scenario the recoverable loss would be calculated as follows:

$600,000 [Has] / (80% X $1,000,000) [Should Have] X $300,000 [Loss] -$50,000 [Deductible] = Loss Payable

In this example of under-insured property, the coinsurance requirement of 80% resulted in a penalty of 25% of the loss or a reduction of $75,000 ($300,000 – $225,000).

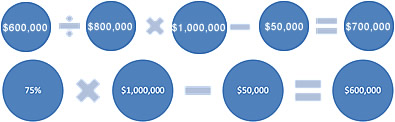

Taking the same example as above but assuming a total loss, the recoverable loss would be as follows:

$600,000 [Has] / $800,000 [Should Have] X $1,000,000 [Loss] – $50,000 [Deductible] = $700,000

$600,000 Limit of Insurance [Has] = Loss Payable

In this example, the insured is limited to the $600,000 limit of insurance purchased, or $400,000 less than the replacement cost of the property (40% of the value). If minimum insurance had been purchased, coverage would have been afforded to 80% of replacement cost or $800,000.

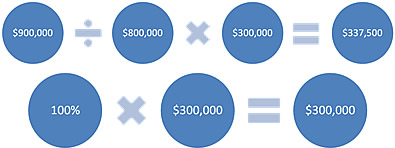

Taking the example one step further using the partial loss scenario and assuming the insured has more insurance than is required:

$900,000 [Has] / $800,000 [Should Have] X $300,000 [Loss] = $337,500 [Calculated Loss before Deductible] – $50,000 [Deductible]

$300,000 Loss Amount = Loss Payable before deductible (there is no gain for over insuring)

In this example, the calculated loss before deductible of $337,500 is greater than the loss amount of $300,000. In this instance, the collectible amount is limited to the actual loss amount of $300,000 less the $50,000 deductible and no gain is realized for over insuring the property.

It is important, when calculating the coinsurance payment, to consider all properties in the valuation to which the limit applies, whether affected by physical damage or not. This can mean the insured having to prove up, often times to the independent claims accountant, values for several locations.

In return for the coinsurance requirement, insureds are provided rate reductions on premiums paid. At higher coinsurance requirements, while the insured must purchase more insurance it is done at a reduced rate. Conversely, at coinsurance rates below 80%, the rate is higher (effectively a surcharge is typically charged).

The building value and the business personal property/equipment values are commonly separate values with separate limits and conditions. Both are typically valued at replacement cost as of the date of the loss which makes it imperative that the insured understands the ramifications of the values being reported and therefore the insurance being purchased and that these values are regularly revisited to ensure adequate coverage protection. Several circumstances could result in the insufficient purchase of insurance such as:

- The historical expensing of equipment and inventory, which results in those items not being captured on the asset ledgers and therefore not being included in the reported values for purchasing insurance.

- Change in materials and construction costs affecting replacement cost valuations.

- The cessation of several large off-site projects, which results in the return of major equipment to the main warehouse not previously included in the reported values.

- Plant expansions, leasehold improvements or other changes in operations.

Any of these circumstances could result in situations where the insurance required, or the “Should Have” insurance as of the date of the loss is substantially greater than the insurance limit or the insurance the insured “Has” thereby resulting in a coinsurance penalty.

Coinsurance as it Applies to Business Income Loss Coverage

The provision for the coinsurance requirement (or contribution clause) in business income loss coverage works very much like the coinsurance requirement in property damage coverage with the exception of the valuation. Property damage is often valued at replacement cost as of the date of the loss; whereas, business income is typically the total net income and operating expenses that would have been earned or incurred, had no loss occurred, for the 12-month period beginning with the policy inception.4

Factors that need to be considered include whether payroll is insured, the company’s growth factor, industry trends and any other anticipated changes in the business. As with the property values, the business income loss values need to be revisited routinely. The coinsurance requirement can vary from 50% to 125%. Any coinsurance penalty applies only to the business income loss recovery and does not apply to extra expense recovery.

In the following example, payroll costs were excluded from coverage and thus these costs were eliminated in arriving at the value of the business income during the 12-month period subsequent to the inception of the policy:

View the Calculation of Business Income Value table

According to the insurance policy in question for the calculated value noted on the previous page, ordinary payroll was not insured and certain operating expenses were specifically identified in the policy as expenses to be deducted in arriving at operating expenses for purposes of determining any coinsurance penalty. Alternately, a policy may specify only those expenses that may be considered in arriving at operating expenses for determining the coinsurance condition. In this example, annual net income was projected had no loss occurred in the amount of $1,503,445.08, which was added to continuing operating expenses (projected again had no loss occurred and according to specific policy stipulations) in the amount of $1,366,897.58 to arrive at a total business income valuation of $2,870,342.66.

Based upon the calculated value of $2,870,342.66, with a coinsurance requirement of 100% and the insured only maintained insurance of $1,800,750, the calculation of loss and any coinsurance penalty is as follows:

View the Summary of Business Interruption Loss table

In this example, the insurance maintained [Has] of $1,800,750.00 is only 62.74% of the insurance required [Should Have] of $2,870,342.66 (or $2,870,342.66 X 100%), which results in a 37.26% coinsurance penalty to the recoverable loss.

Agreed Value Optional Coverage

No discussion of coinsurance would be complete without discussion of the Agreed Value Optional Coverage [Property] and the Business Income Agreed Value Optional Coverage [Business Income]. As a result of the issues discussed above inherent in making sure adequate insurance is being maintained to avoid a coinsurance penalty in the event of a loss, the insured is able to obtain this “Agreed Coverage” which temporarily suspends the insurance policy coinsurance clause. By submitting a statement of values reflecting an insurable value of the property to be insured to underwriters (and once accepted by underwriters), this optional coverage suspends the coinsurance clause until the expiration date of the optional coverage, typically one year. If the optional coverage lapses and is not renewed with updated values, the policy automatically reverts back to the coinsurance clause. Typically, a small additional premium is charged for the optional coverage.

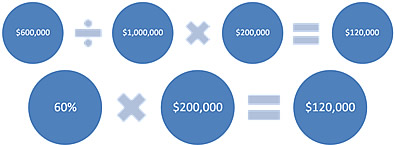

It should be noted however, that with the agreed value option, the insurer is required to pay “no more for loss of or damage to covered property than the proportion that the Limit of Insurance for the property bears to the applicable agreed value.”5 In other words, the optional coverage requires that the insured carry the amount of insurance stated in the agreed values. For example assume the following:

- Agreed Value $1,000,000

- Limit of Insurance $600,000

- Loss amount $200,000

Where:

$600,000 [Limit] / $1,000,000 [Agreed Value] X $200,000 [Loss] = Loss Payable – Deductible

In this example, the loss payable is limited by the lack of insurance in proportion to the agreed value. It is also important to note that in the event of a total loss, the agreed value is not necessarily the amount that will be paid out at the time of loss; consideration needs to be given to the valuation clause and other provisions of the insurance policy.

Conclusion

Often misunderstood, coinsurance attempts to make sure that insureds are held accountable for adequately insuring their property. If adequately insured, policyholders are rewarded with a lower cost of insurance and if not, policyholders become “co-insurers” via the coinsurance penalty for the prorated share of the insurance shortfall. In order to maintain adequate insurance, it is imperative that the insured routinely revisit the limits of insurance in comparison to the values of both physical/personal property and business income producing property.

Once a loss has occurred and the insurance policy has been triggered, as independent accountants, we are often engaged to determine coinsurance provisions such as business income valuations in the course of our calculations of loss. The various examples of coinsurance calculations set forth above will hopefully serve as a guide; each loss should be evaluated separately based upon the specific applicable policy language and the facts and merits of each case.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

In other words, insureds seeking to insure their property for an amount close to or equal to its actual value.

A reduction is needed from this amount for any applicable insurance policy deductible; however in the AAIS Commercial Property coinsurance provision, the deductible is subtracted from the loss before application of the coinsurance percentage.

Limit of Insurance specified in the policy Declarations page.

Up until a few years ago valuation for purposes of determining any coinsurance condition according the standard ISO coinsurance clause applied to the 12-month period following the date of loss rather than the date of policy inception. This made the matching of “Has”(insurance purchased) and “Should Have”(insurance needed) more difficult due to the timing between the policy inception date when insurance was acquired and the date of loss when the loss was valued.

The Society of St. Vincent De Paul In The Archdiocese of Detroit v. Mt. Hawley Insurance Company, 49 F. Supp. 2d 1011 (E.D. Mich. 1999)