In this post, I touch on a common error I encounter in dealing with a financial analysis of multiple companies owned by the same group or individual. I call this error the “dividend double count”, for reasons that will become apparent momentarily. The error arises in various areas of my practice, but most commonly in the areas of family law and personal injury.

The Issue

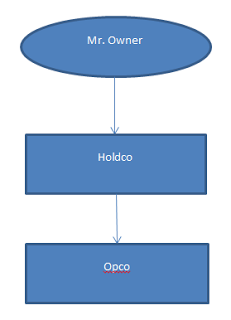

The error is as follows. Consider the following simple ownership structure:

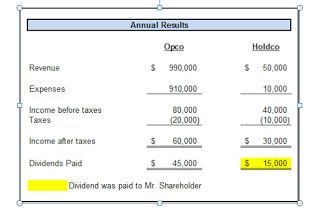

Now, suppose that during the most recent calendar year, the following results were reported:

The question that arises in a family law context is: what was the pre-tax income available to Mr. Shareholder? An intuitive response might be to simply look at the “income before taxes” line on the income statements of Opco and Holdco, and take the sum of $120,000 (i.e. $80,000 + $40,000). Some may also be tempted to pick up the $15,000 in dividends paid to Mr. Shareholder.

But this would be wrong.

Opco shows dividends paid of $45,000. Holdco is the sole shareholder of Opco, so those dividends – which have not been deducted in calculating Opco’s income before taxes – are appearing as part of Holdco’s revenue (along with some miscellaneous revenue).

Had Opco paid out a $45,000 management fee to Holdco, the analysis would be much simpler; the management fee would show as an expense to Opco and as revenue to Holdco; the impact on the combined net income of the two companies would be neutral. The problem really arises because dividends are not deducted in calculating income. In order to calculate the overall pre-tax income, it is necessary to deduct the $45,000 in intercompany dividends. The actual pre-tax income of the two corporations is $120,000 – $45,000 = $75,000.

(The same commentary would apply to the $15,000 reported by Mr. Shareholder on his personal tax return; these have been paid out of Holdco’s pre-tax income, and should not be included again at the personal level in analyzing Mr. Shareholder’s income).

Other Contexts

This issue also arises in other situations. A number of years ago I analyzed the income of a group of real estate development companies in the context of a claim for personal injury damages. The plaintiff’s expert had presented a claim based on a decline in net income between the pre-accident and post-accident periods, but had neglected to consider the distortions created by the issuance of large intercompany dividends.

Conclusion

Dividends issued from one company to another are included in the income of the recipient, but are not deducted from the income of the issuer.[1] In analysing the revenue or profitability of a group of companies, it is important to gain an understanding of how the revenue of each company is generated in order to gain a proper picture and to avoid double counting.

By Ephraim Stulberg.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

The Income Tax Act recognizes this; intercompany dividends amongst related companies are not subject to tax in the hands of the recipient company.