The below article first appeared in THE STANDARD, New England’s Insurance Magazine. It features excerpts from a presentation given by MDD partners Paul McGowan, CPA, CVA and Jon Ducey, CPA, CVA on the topic of liability claims and other key underwriting and claims considerations.

Parts shortages resulting from a fire at a supplier halted production of the nation’s top-selling vehicle for several days this month. Ford Motor Company has been working to mitigate its U.S. production losses on its F-150 trucks due to a shortage of die-cast components.

The production disruption highlights the vulnerability of supply chains. Just one missing part is enough to disrupt the entire production cycle. It begs the question: How well do you know the suppliers and suppliers of the suppliers to your clients?

While most of us normally think of commercial property time element coverages in this kind of situation, liability issues also come into play. This is particularly important in matters where the underlying cause may not be attributable to an insured peril or covered cause of loss under conventional commercial property policies. In either case, the message is still the same, does everyone, underwriters and agents in particular, truly understand the impact that a supplier can have on the client’s business?

Paul McGowan, CPA, CVA, and Jon Ducey, CPA, CVA, partners of MDD Forensic Accountants, recently discussed liability claims and other key underwriting and claim considerations with members of the Boston chapter of the CPCU Society. “Are we asking enough questions of our clients? Once you understand a significant component of a product is coming from a supplier, wouldn’t we want to know whether the supplier of the supplier has enough coverage? You should be asking your client what level of diligence they are doing to make sure that the supplier of their supplier is going to be there to indemnify them and keep them going if there is a limits loss, particularly in those situations where the only recourse to the client is to recover the damages from the supplier,” McGowan said.

“While the underwriter can protect the carrier’s risk by applying limits, the client may be driven out of business if the limits were not adequate. Hence, did the agent/underwriter sufficiently understand the exposure, and, if not, does this create a liability problem for the agent or broker?” he added.

Lost Profit Cases

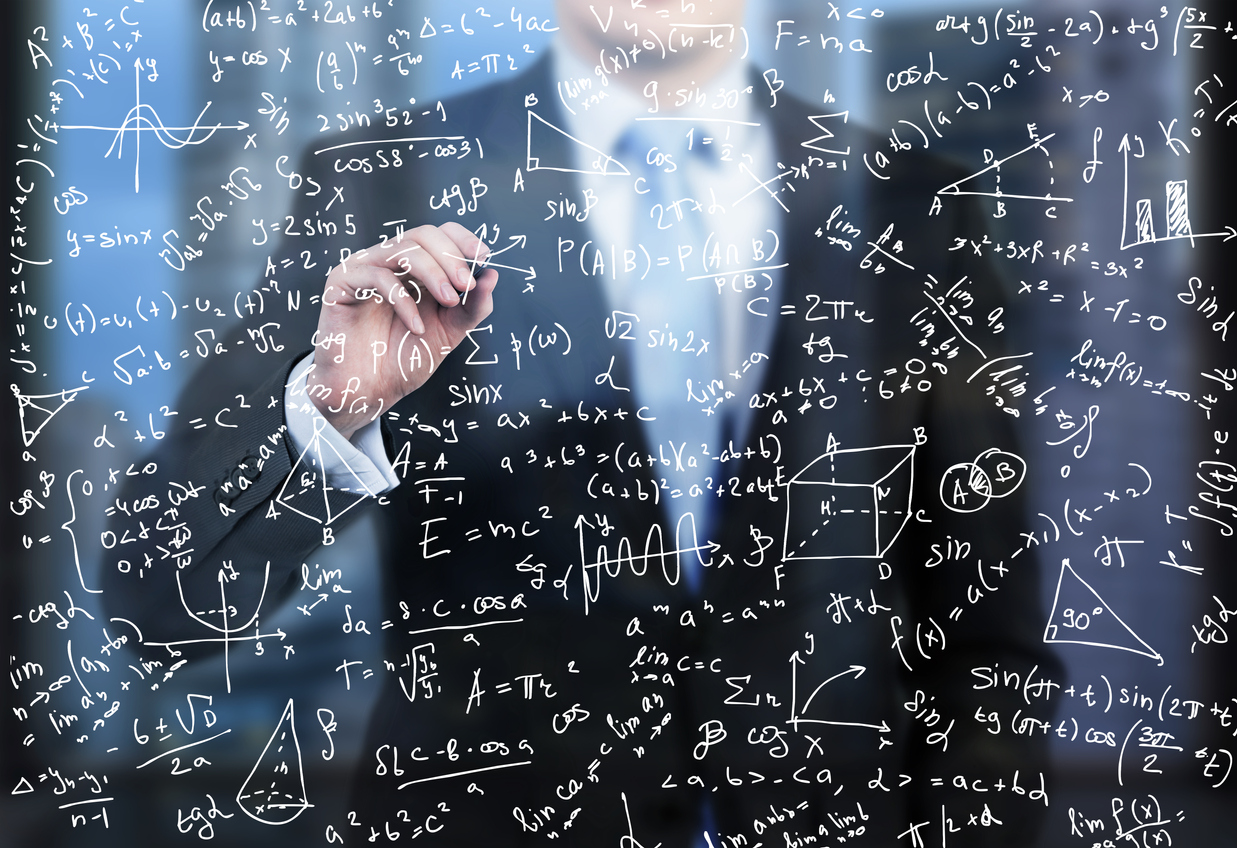

When there is a lost profits case involving liability claims, carriers and forensic accountants have to identify what the lost revenue is. In other words, they look at what the business would have done for revenues but for the occurrence and compare that figure with how it actually performed. “That differential is, generally speaking, the lost revenue from the event, subject to certain caveats. Lost revenue has to be driven from the event, you can’t have an external impact that also impacts your actual sales,” said McGowan. There has to be an analysis, which is why carriers hire forensic accountants.

It is important to mention that the projected revenue has to be realistic, noted Ducey. For an existing business, forensic accountants might typically analyze the prior two years’ history to develop a trend, looking at year-over-year results on a monthly basis. Within that time period, they would try to identify any seasonality as well.

Once the lost sale has been identified, the next step is to determine if the business would have incurred costs to make the sale. Consider the example of a car service for hire. The driver crashes the limousine. The vehicle would have generated revenue, but now it’s out of service. If it hadn’t been involved in an accident, the limo business would have had to pay the driver as well as buy gas and pay any maintenance or repair fees. The limo company is losing the $130 per ride service, but it is not incurring the costs of gas, tolls, the driver, etc., that it normally would have incurred, noted McGowan.

“The next step is to take those lost revenues and back away the avoided or saved costs that never occurred. If they took in $100 but had to pay $30 out, they would only have been left with $70. So, we try to get down to what they would have been left with.”

The lost revenue less the saved costs equals lost profits (see below chart “Simplified Formula for Lost Profits”). Now suppose, the limo driver is without his limo for three months while repairs are being completed. What if the driver could rent another limo to use to continue to generate revenue? That’s an example where there might be some increased costs – i.e., the cost to rent a limo to mitigate the lost profits, explained Ducey.

Simplified Formula for Lost Profits

| Formula | Comments | Considerations | |

| Lost Revenue | Projected revenue “but for” event, less actual revenue [including from mitigation] | Reduction must be attributable to the event. | |

| Minus | Saved/Avoided Costs | Deduct those costs that would have been incurred, and were saved or avoided, to generate the “but for” revenue but were not incurred due to the suspension of operations. | Types of costs will vary by case and applicable laws. |

| Equals | Subtotal Lost Profits | ||

| Plus | Increased Costs for Mitigation | What were the increased costs to mitigate the loss? Important: Did the claimant attempt to mitigate the loss [e.g., rent another truck, temporary location, etc.]? | Increase must be attributable to the event and not other circumstances. Mitigation requirements can vary by type of case. |

| Equals | Total Lost Profits |

“It’s what they lose in terms of revenue (if any), less what they save or avoid, plus any increased costs. All driven by being applicable to the event itself,” said McGowan.

While the limo company example starts from the top line (lost revenue) and works its way down, another approach is to add up from the bottom. A CPCU Society member asked McGowan the difference between the two.

“Many commercial property policies, for example, are written on a net profits plus continuing fixed cost basis. Generally speaking, in the U.S. they’ll also use gross earnings forms or gross profits forms, which require a little bit of nuance. You’ll generally get to the same number under the net profits plus continuing fixed cost basis versus the gross earnings method absent any other coverage limitations like ordinary payroll and other items that are excluded,” explained McGowan.

“When you start from the top with revenue and subtract those costs that are not being incurred, some business owners may feel like you’re not addressing their ongoing costs. In those cases, we may also calculate the loss to reflect their lost net income plus continuing expenses in accordance with the policy form,” added Ducey.

Case Studies

McGowan and Ducey discussed several case scenarios to highlight key takeaways when analyzing claims. It is important to note that the examples discussed in this article have been embellished for purposes of emphasizing certain points, while also disguising the actual parties involved in the various matters. The presentation was intended for general guidance, did not constitute work product and was not intended to be a substitute for detailed research or the exercise of professional judgment in specific matters.

Cyber Health-Care Case:

Adult day care (ADC) provides day-care services to adult patients. Claims and payments are processed by a middleman. The health-care provider makes the payment, but ADC never receives it and makes a claim for lost accounts receivable coverage.

The answers to several questions need to be determined: Is it a covered loss? Who is at fault? What is the exposure to the revenue cycle? Would the carrier pay the claim? Attendees agreed that the property insurer wouldn’t pay the claim because accounts receivable coverage is for detectable damage to the account receivable, and ADC never received the funds.

Now, suppose that the middleman realized that the health-care provider had a cyber intrusion. A cyber thief stole the administrative account information and diverted the money to a fraudulent bank account for ADC.

“Until I understood the revenue cycle, I would not have thought that there was a middleman processing these payments,” said McGowan.

Rideshare Driver Liability Case:

A driver for a rideshare company, such as Uber, has a medical event while driving with passengers in the vehicle. The car veers onto a sidewalk, crashing into a retail store. The driver and passengers are injured. Two pedestrians die from injuries they sustained. There is also potential damage to the retail storefront the car crashed into.

Uber provides its drivers with at least $1 million of total third-party liability coverage when a driver is on the way to pick up a passenger or if a passenger is in the car. The insurance covers the driver’s liability for damages to any third party, such as the passengers in the vehicle, another driver, pedestrians or property in case of an accident.

Is $1 million enough coverage? Not if two people died and there are injured passengers, noted Ducey. “You could be looking at medical costs, lost earnings, losses to the estates of the deceased pedestrians, funeral costs, pain and suffering, punitive damages, the loss of companionship, etc. These are just some of the types of damages that an estate could look to collect from an at-fault party. Then there’s the property damage and lost profits for the retail store.”

Ducey said the key takeaway is to make sure there are sufficient limits, even if it’s a worse-case scenario.

Warehouse Liability Case:

A warehouse is filled with rolls of manufactured paper stored for various external customers. The warehouse owner retains a welding company to spot repair the metal roof. While welding, some of the slag drops onto the paper stored below, igniting the building and its contents.

The first question that should be asked is why the welder didn’t tell the warehouse owner to move the paper, according to Ducey. “This is where education, training and experience factors in and knowing the customer that you’re doing the work for.”

Was there a fire suppression system in the building? If so, why didn’t it go off? Does the contractor know that if someone is welding on the roof, there should be someone below on a fire watch? What happens if the warehouse employee assigned to “fire watch” left for lunch without telling anyone?

Does the contract between the welder and warehouse limit damages? In this case, the types of damages include property damage to the warehouse and lost profits while the repairs are ongoing because product can’t be stored there. In addition, there could be lost future business from customers that don’t return.

Customers’ inventory had also been stored in the warehouse. What are the contract terms between the warehouse and its customers? Will those customers present a claim with their own insurer and then look to subrogate against the warehouse and the welder? Other issues surround quantities. One customer may say he had a higher quantity of paper rolls than the warehouse records show. Who’s right? The inventory is gone and can’t be counted.

Lastly, valuation must be determined in liability matters, namely actual cash value (ACV) versus selling price versus replacement costs. The claimant may only be entitled to recover the actual cash value, and there will be a difference between selling price and ACV.

McGowan noted that this is where knowing your client comes into play. “One of the things that has gotten lost is personal communication. You need to have a one-on-one conversation, not just a checklist. When there’s ultimately an event that gives rise to a claim or demand, we speak with the insured or claimant in order to understand their business and what happened before calculating the loss. Learn your client’s business upfront to make sure they’re adequately insured instead of having them fill out the checklists. It’s tough. You don’t have an easy job.”

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.