One of the biggest trends shaping society today is the widespread adoption of Electric Vehicles (EVs). While Tesla pioneered this movement as a disruptor, nearly every automobile manufacturer worldwide is now actively developing its own electric vehicles. Governments have implemented measures to encourage the uptake of EVs, aiming to improve air quality, mitigate noise and pollution, and align with efforts to reduce carbon emissions.

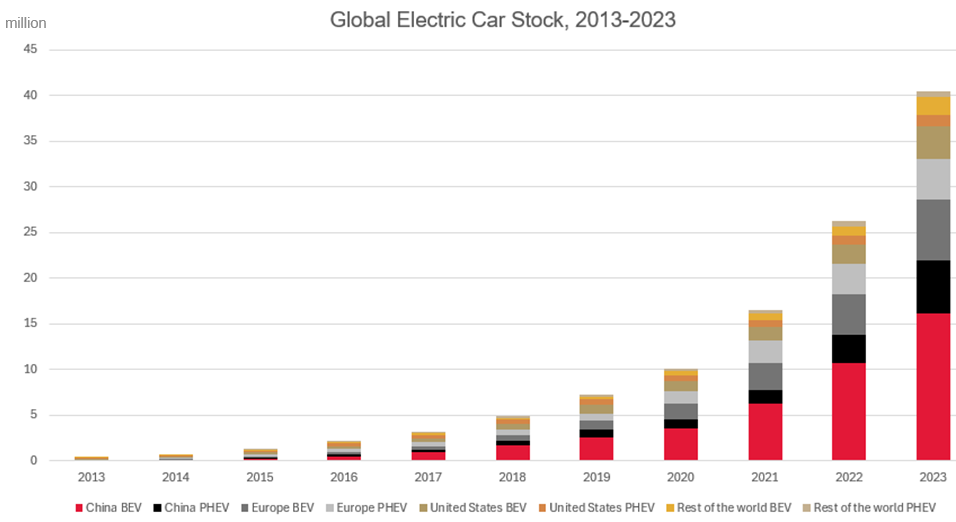

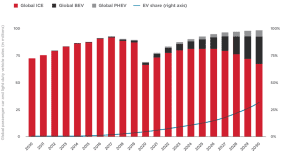

The chart below illustrates the growth of EV stock (i.e., vehicles on the road) from 2013 to 2023. The data reveals remarkable growth, with EVs more than tripling in just three years.

In 2021, the surge in EV sales marked a significant turning point, even amid the challenges posed by the pandemic and supply chain issues. The consensus is that this uptick was bolstered by Covid-19 related stimulus measures provided to EV manufacturers only (i.e. no similar incentives for conventional car manufacturers), as seen in Germany. Additionally, the proliferation of EV models and the continuous expansion of both public and private charging station networks played a pivotal role in driving the increased adoption of EVs.

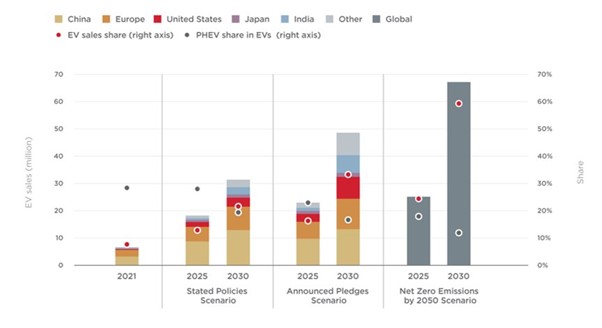

The next chart shows the growth based on the Stated Policies, Announced Pledges and Net Zero Emissions by 2050 Scenarios.

The expansion of EV adoption creates the need for a major increase in charging infrastructure and additional power generation to ‘refuel’ these vehicles. What’s more, the minerals used in EV production differ greatly from those used in conventional vehicle production. While these challenges may be apparent, how specifically do EVs pose challenges and bring about changes in the Oil & Gas industry?

EVs and the Oil and Gas market

More EVs mean More Natural Gas

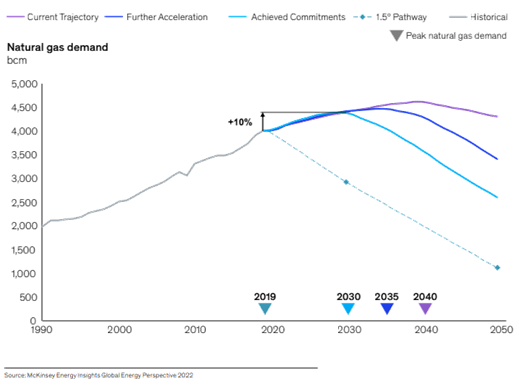

EVs are powered by electricity that is mostly generated by the combustion of coal and natural gas. More electricity will need to be generated in order to charge EVs. To align with the crucial 1.5°C threshold, it is imperative that the demand for natural gas decreases moving forward. However, owing to its cleaner combustion, the demand for natural gas is anticipated to grow in the short- and medium-term future, reaching its peak around 2030 to 2040 in different scenarios. Beyond this point, it is expected to transition into a supporting role, serving as a backup to renewable energy sources.

Reduced Demand for Transportation Fuels

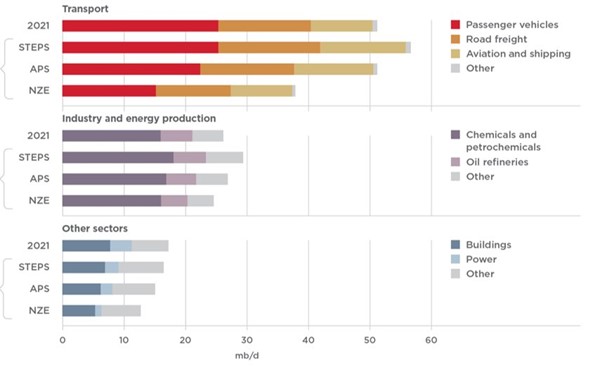

The most significant impact is expected to be felt by gasoline, as it is primarily utilized for light-duty passenger vehicles, and the market for these vehicles is undergoing a shift towards electric alternatives. The transportation sector is a major consumer of petroleum products such as diesel and gasoline and accounts for nearly 60% of global demand. According to the Net Zero Emissions by 2050 Scenario, if conventional fossil-fuelled vehicles were to fall to 33% of all vehicle sales by 2030, a significant proportion of the global demand for diesel and gasoline would diminish.

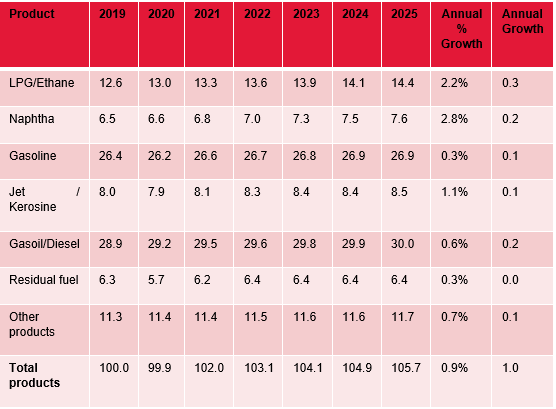

The graph below, published by the IEA, demonstrates the stagnating demand for gasoline and diesel. While all fossil fuel products, on average, were expected to grow annually by 0.9% from 2019 to 2025, gasoline is expected to grow by only 0.3% and diesel by 0.6%.

Global Oil Demand by Product (mb/d)

It is important to highlight that overall vehicle sales are still expected to grow. This is evident in the chart below, based on the most pessimistic Stated Policies Scenario, where we can see a decline in Internal Combustion Engine (ICE) and a simultaneous growth in EVs.

Outlook for Global Passenger Car and Light Duty Vehicle Sales: to 2030

The next chart clearly shows how transport is expected to lead the way in reduced demand for oil by 2030 under the Net Zero Emissions scenario.

Oil Demand by Sector & Scenario to 2030

From the above, you might conclude that the future of oil refining is looking bleak. The emergence of EVs means reduced overall demand for oil and that the demand for gasoline, and to some extent diesel, will fall drastically.

Increased demand for Automotive Plastics

However, whilst the shift to EVs will cause a decline in gasoline demand, it also means an increased demand for automotive plastics (olefins).

EVs tend to be significantly heavier than their ICE counterparts. For instance, even with similar dimensions, a Tesla Model 3 can weigh 1,000 lbs more than the heaviest Toyota Camry. This added weight impacts the vehicle’s overall performance and efficiency, necessitating engineering solutions to reduce the EV’s weight.

In 2020, approximately 6% of a vehicle’s weight was made of plastics and composites. According to estimates by the Center for Automotive Research (CAR), this figure is expected to rise to 8% by 2025 and reach 15% by 2040. What better way to reduce weight than to replace parts with plastic? High-performance plastics can mimic the strength of metals while significantly reducing the overall weight of the vehicle.

Adaptation of Refineries

As the demand for fuel diminishes and the demand for olefins increases, a critical question arises: how will refiners adapt to this shifting landscape?

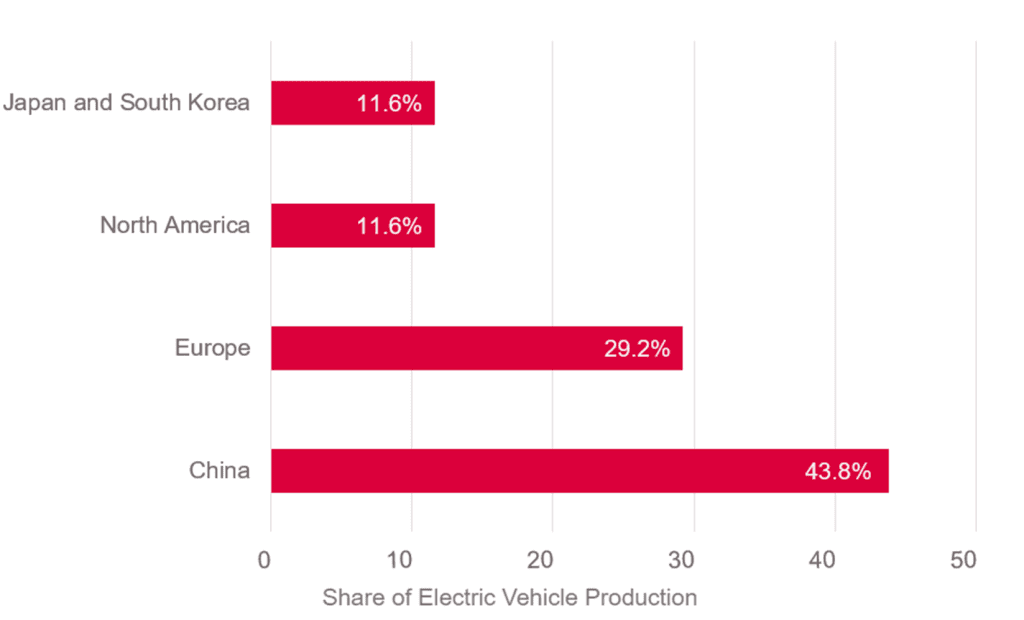

By 2027, it is anticipated that the majority of EV production will be concentrated in Europe and China, accounting for a combined 73%. The geographical location of EV manufacturing will play a pivotal role in determining which petrochemical feedstocks will experience heightened demand.

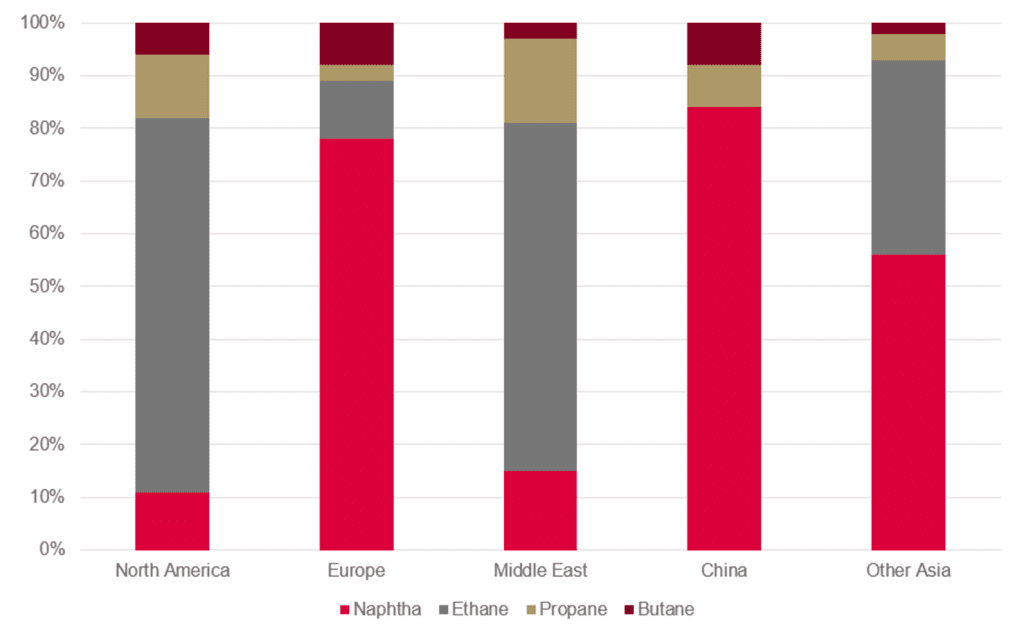

Cracker Feedstock Mix by Region

North America and the Middle East primarily use Ethane in their crackers (around 70%), while Europe and China rely heavily on Naphtha (around 80%). One might conclude that the plastic used in manufacturing these EVs will be naphtha derived as opposed to Ethane derived, if relative feedstock usage remains consistent by 2027.

Forward-looking refiners are actively looking for opportunities to adjust or modify their production strategies to capture the growing demand for petrochemicals. This may involve increasing their output of naphtha and propylene or considering the transition to Crude Oil to Chemical Plants (COTC). Such adaptations require varying degrees of complexity and integration within the refining process, the merging of traditional refineries and petrochemical plants, the use of new technologies, some of which are still conceptional, and all at huge scale. It also means that this strategic shift comes with an increased risk exposure, potentially leading to larger insurance claims.

EVs and Power Generation

With the huge uptick in EVs expected in the next few years (as mentioned above – there is expected to be 42 million more EV’s on the road by 2025 than in 2021), there arises a critical concern regarding the charging infrastructure and its impact on the overall electrical grid power demand.

According to the International Energy Agency, EVs could potentially require between 525 TWh and 860 TWh of electricity globally by 2030, a substantial increase from 80 TWh in 2022. While that would equal just a small share of global electricity consumption, ranging from an estimated 2% to 5% in the U.S., it is important to note that the power requirements for EVs could surpass three times the current electricity consumption of California, the world’s fifth-largest economy.

Charging Infrastructure

The public charging infrastructure plays a pivotal role in facilitating the widespread adoption of EVs.

As of 2022, there were 2.7 million public charging points globally. 900,000 of these were installed over the year, accounting for 55% growth from 2021. In Europe, over 450,000 publicly available EV charging points were operational by the same year.

By 2025, it’s estimated that 1.3 million charging stations will be publicly accessible, and the number should increase to 2.9 million by 2030.

However, as of June 2023, there were around 45,000 charging points in the UK. Despite a rising monthly installation rate, the UK government’s target of achieving 300,000 public charging stations by 2030 may face challenges, with projections indicating a potential shortfall of over 100,000 charging points.

Load management challenges

The charging patterns of electric vehicles may create challenges for grid operators and power companies.

According to data from Energy Insights by McKinsey Global Energy Perspective, while it is unlikely that the increased volume of EV will cause a significant increase in total power demand, it is expected to reshape the electricity load curve. The most notable effect is anticipated to be an increase in evening peak loads, as individuals tend to will plug in their EVs to charge overnight.

While the system level as a whole can likely absorb these increases, challenges may arise at a local level, especially in city suburbs, where the concentration of EVs are residential hotspots.

To forecast changes in the load curve within residential areas, McKinsey conducted a Monte Carlo analysis. For a typical residential feeder circuit serving 150 homes with a 25% local EV penetration, the analysis indicated that the local peak load would increase by approximately 30%.

Battery Storage

In the USA, there are only around 16,000 public charging stations and some people are reluctant to buy EVs because they worry about running out of power during their journeys. In addition, most of these existing public charging stations are slow to charge, for example, a battery operated charger would take five to ten hours to “fill up” at a Level 2 station.

However, the introduction of direct current fast charges could significantly reduce the charging times and on-site battery storage at EV stations can mitigate load peaks. These batteries can charge from the grid at times when costs are lower, store the power, and release it during peak demand (a practice known as peak shaving).

When a car arrives, the on-site battery can deliver electricity at 150 kilowatts without drawing power directly from the grid. If two vehicles arrive, one can draw power from the battery while the other utilises the grid. In either case, the economics improve because the cost of both the electricity itself and the demand charges are greatly reduced.

Smart charging and vehicle-to-grid (V2G)

To accommodate the growing number of EVs, power companies are working on grid integration and implementing smart charging technologies. Smart charging systems can optimize the charging process, by considering factors such as electricity demand, renewable energy availability, and grid stability.

The ‘smart’ use of the electricity system involves strategically shifting electricity consumption to periods of low demand. Consumers can benefit from cheaper power costs, while operators enjoy the advantages of a more balanced system, avoiding simultaneous charging peaks, such as at the end of rush hour.

In addition, an extension of smart charging is the concept of ‘Vehicle to Grid’ (V2G). When supply is low and demand is high, EVs connected to the grid to charge can redirect power back into the grid. Owners of the vehicles can be compensated for providing this balancing service, similar to operators of electricity storage units. In theory, if a vehicle is needed to be charged at a specific time, the owner could register that time, preventing the use of the car as a power source.

Alongside V2G, there is vehicle-to-everything (V2X) technologies, which enable the transfer of electricity between vehicles, the grid, batteries, or buildings. This means that EVs can be used to power homes. EV owners can use their vehicles to supply energy back to the grid or use their car batteries to power their homes during times of power outages or high energy usage. This helps reduce the demand for electricity from traditional power sources.

Renewable energy integration

The rise of electric vehicles has accelerated interest in renewable energy sources. Notably, solar and wind power provide cleaner and more sustainable options for generating electricity to charge EVs. Power companies are increasingly looking to invest in and integrate renewables into their generation portfolios to address the growing demand for EV charging while aligning with emission reduction goals.

Solar-powered EV charging stations have begun appearing in many cities globally, including San Francisco, LA, and New York. Furthermore, many car manufacturers have seized the opportunity to incorporate renewable energy solutions into their production process.

Renewable energy availability

The main advantage of EVs lies in their potential to reduce greenhouse gas emissions and air pollution when compared to conventional internal combustion engine vehicles, but this advantage is heavily dependent on the source of electricity used to charge them.

The environmental impact of EVs is contingent upon the greenness of the power grid they draw from. For example, if you drive an electric vehicle in Norway, where most electricity is powered by near zero emission hydroelectricity, you’re contributing much lower levels of CO2. In contrast, if you drive the same car in China, where most electricity comes from coal-fired power stations, you may be contributing as much CO2 equivalent of using two-thirds of a tank of petrol. One study found that over 90,000 miles, a petrol-powered car created only 24% more carbon dioxide than a similar sized EV run on electricity produced from natural gas.

The ideal scenario for maximizing the environmental benefits of EVs is to charge them using renewable and low-carbon energy sources. These include solar, wind, hydroelectric, geothermal, and other sustainable sources of electricity. When powered by green energy, EVs can significantly reduce carbon dioxide emissions and contribute to a cleaner and more sustainable transportation system.

However, if EVs are charged using electricity generated from fossil fuels (e.g., coal, natural gas, or oil), they may not offer significant environmental advantages over traditional vehicles in terms of emissions. In some cases, they could even have a higher carbon footprint than efficient gasoline or diesel vehicles.

EV Battery End of Life

The end-of-life of EV batteries is a critical aspect within the electric vehicle ecosystem. EV batteries undergo degradation over time, typically experiencing a gradual reduction in their capacity and range as they undergo charge and discharge cycles. When an EV battery reaches the end of its life, it no longer meets the required capacity or range for the vehicle’s intended use. Concerns often arise about the potential environmental impact if these batteries end up in landfills. However, most modern EV batteries, with a life expectancy of 15 to 20 years, are designed for a second life beyond their primary use.

Recycling plays a crucial role in managing end-of-life EV batteries. Some techniques allow for up to 95% of raw materials to be recycled. The process involves disassembling the battery pack, separating its components, and recycling valuable materials such as lithium, cobalt, nickel, and other metals. These recycled materials can be used to manufacture new batteries or other products, reducing the environmental impact of mining and resource extraction. Some governments are implementing mandates for EV batteries to be designed and manufactured with recyclability in mind.

If we look briefly into how exactly EV batteries are recycled, the process often involves smelting, which consumes substantial energy and creates toxic emissions. The smelting process also results in the loss of some metals and minerals, which have taken a lot of effort to extract from the ground. This process is far from being environmentally friendly, prompting companies to explore innovative and more sustainable recycling methods.

Some EV manufacturers and recycling companies explore second-life applications for used EV batteries. Even though these batteries may no longer provide sufficient capacity requirements for EVs, they may still have enough life left for less demanding applications, such as energy storage units. These used batteries can be repurposed for backup power systems or renewable energy storage. For example, Nissan employs ex-EV batteries to provide backup power to the Amsterdam Arena, while Toyota installs old EV batteries outside stores in Japan to store power generated from solar panels.

Some organizations repurpose used EV batteries for non-automotive applications, such as powering outdoor lighting, garden equipment, or portable power banks. These applications do not require the same level of performance as an EV, making them a viable option for repurposed batteries.

Concern also arises when recycling or repurposing is not feasible, and end-of-life EV batteries must be disposed of. The disposal of EVs is controversial and perceived by many to be a climate threat. If improperly disposed of in landfills, batteries can release toxins, including heavy metals that may contaminate soil and groundwater. Additionally, EVs in landfills pose a fire risk, as damaged batteries can short circuit and ignite.

Manufacturers and policymakers are actively working to address the challenges associated with end-of-life batteries to foster a more sustainable and environmentally responsible EV industry.

EVs and Mining

The shift towards electrification means a greater demand for specific minerals and metals, particularly because EVs rely on huge, mineral intensive batteries to power the vehicles.

If we look at the materials needed to make an EV, the metals depicted in the image below are poised to see a significant surge in importance in the future. This includes copper for the extensive wiring required, iron and steel for infrastructure, as well as lithium, cobalt, manganese, graphite, and nickel as they are crucial for battery cathodes.

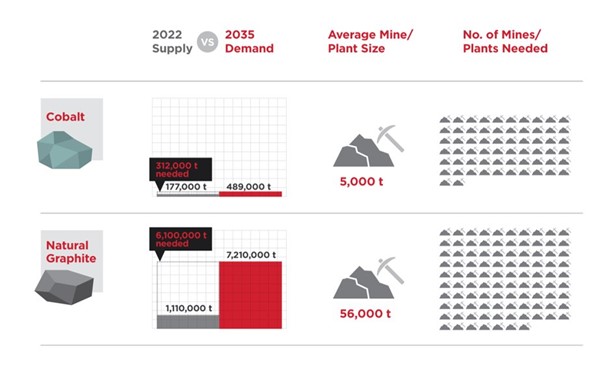

Where are all these minerals and metals going to come from? The answer is that they need to be mined from the ground, which, in turn, entails the opening of numerous new mines. For many of these battery minerals, the common challenge is that there is simply not enough supply to match the projected demand.

Cobalt

Taking Cobalt, for instance, its demand is projected to nearly triple by 2035. With an average mine size of 5,000 tons, meeting this demand by tripling production will require approximately 55 new mines. Meeting this target alone may present a bumpy ride for pricing of Cobalt in the future. Adding complexity to the picture is the fact that a significant portion of the world’s Cobalt reserves is concentrated in the Democratic Republic of the Congo (DRC) and intense competition for these resources, especially from the world’s top consumer in China, could further complicate pricing dynamics.

Natural Graphite

Natural Graphite is another crucial mineral required in substantial quantities for EVs, and demand is anticipated to increase nearly sixfold by 2035. As illustrated in the chart below, the graphics are of the same size, but the average graphite mine is 10 times larger than the average Cobalt mine. Meeting this projection would require the establishment of nearly 100 new mines by 2035. The sheer scale of the needed resources is enormous.

Where will these mines be developed? How quickly can they navigate through environmental reviews, if at all? And what will be the duration of the commissioning and infrastructure build-out? The intricacies of this timeline alone cast doubts on achieving these production levels by 2035.

Lithium

When considering lithium, a magical element that is now considered to be one of the most precious metals on Earth, concerns arise regarding its supply, with demand projected to increase 22 times by 2050 under BNEF’s Net Zero Scenario. For years, Chile has been the world’s biggest producer of lithium, with the pools in the Salar de Atacama, though small initially, now visible from space. However, Australia has now overtaken Chile as the global leader in lithium production.

Unlike in Chile where lithium is extracted from brine under the surface of salt lakes, Australia predominantly extracts lithium from rocks called spodumene. This mining process mirrors that of copper or iron, involving blasting the material out of the ground. The subsequent processing stage requires significant energy, resulting in greenhouse gas emissions – producing between 5 and 15 tons of carbon for every ton of extracted lithium. Most spodumene mined in Australia is shipped to China for processing, contributing to China’s dominant role in lithium battery production, holding an approximately 80% market share. Shipping large quantities of rock carries a large environmental footprint, not to mention the shipping of the refined lithium back around the world to be put into cars. The production of lithium is, therefore, far from being environmentally friendly.

Furthermore, the overall production of lithium batteries can potentially yield more carbon dioxide emissions than the production of gasoline powered cars, especially if the factory primarily relies on fossil fuels. Approximately 80% of lithium batteries are manufactured in China, where coal serves as the primary energy source, emitting twice the amount of greenhouse gases as natural gas.

The Future of Mining

In December 2023, China released a statement stating that they will no longer export their critical mineral processing technology outside the country – further compounding the supply and demand issues around critical minerals. As such, there is a significant amount of new mine construction expected around the world, an example being Canada where 102 new mines are being constructed.

At MDD’s Energy Insights event in January 2024 Brad Ebel and Conrad Biegel stated, “you’ve got to get dirty to get green”! For us to achieve a green future we need to obtain more critical minerals and the only way of doing this is by more mining.

In the coming years, there’s going to be a boom in construction and that in itself will create additional challenges, such as the shortage of skilled labour, shortage of equipment and transportation challenges. Some mining construction projects will carry more risk, so underwriters will have to consider this when writing policies.

There are also insurers who have recently declined to insure the sector due to their ESG guidelines. These companies may need to revisit these guidelines as a result of China’s position, because without access to heavy rare earths, we may not reach the planned production of EV cars in 2050.

Conclusion

The boom in EVs is poised to have a significant impact across all three energy sectors. The factors discussed above, ranging from the rebalancing of the oil and gas industry to the impact of increased mining activities, the power stability curve, the development of charging infrastructure, and complexities of recycling of EV batteries, collectively form substantial components of this transformative disruption.

Considering everything that has been discussed above, it leaves us with some challenging questions about the transition to EVs. It becomes difficult to avoid questioning whether this shift is merely exchanging one form of environmental impact for another, raising doubts about whether EVs are, “fake news” as Donald Trump might say. Or are they truly delivering environmentally beneficial results?

EVs indeed generate fewer CO2 emissions than petrol and diesel vehicles over their life cycle, but without clean electricity to power them, they won’t deliver the net zero carbon emissions we need to be to combat global warming.

In addition, when we also consider the other environmental, humanitarian, and geopolitical dimensions surrounding EV production and issues such as the immense water loss from delicate ecosystems during lithium refining or the ethical challenges related to child labor in cobalt mining within the DRC, we must question whether, in the pursuit of EVs, we might inadvertently be causing more harm than good.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.