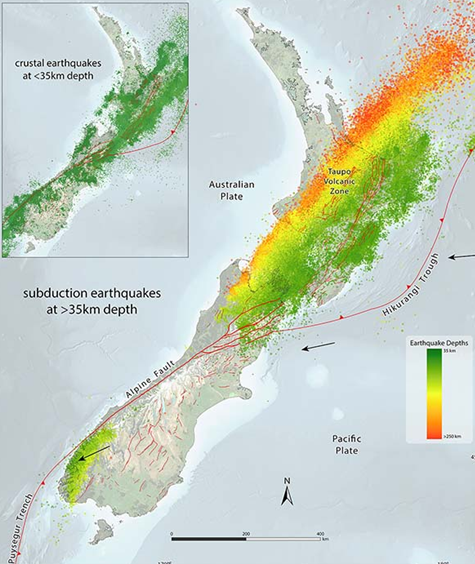

Earthquakes are a historically prominent event in New Zealand, occurring most commonly in the Southern and Eastern areas of the North Island and most of the South Island.

This is because New Zealand falls over the Australian and Pacific tectonic plate boundaries which typically form a subduction zone. The main north and south subduction zones are linked by a series of large fault lines as shown below.

Sub–parallel fault lines subsist through Marlborough at the Northern tip of the South Island (Marlborough Fault System), which is in close proximity to the capital of Wellington. Connecting to this fault system and travelling down the West Coast of the South Island is the Alpine Fault.

Along the Alpine Fault, plates are not only moving past each other but are also moving towards each other. This compressional movement has contributed over time to the rise of a parallel mountain range known as the Southern Alps.

Christchurch Earthquakes

Christchurch City is New Zealand’s third most populated city, the most populated city in the South Island, and is located in the Canterbury region in the central of the South Island. Between 2010 and 2011, four significant earthquake events occurred:

- 4 September 2010, 7.1 magnitude earthquake, weakened the buildings and infrastructure;

- 22 February 2011, 6.3 magnitude aftershock with an epicentre 10 kilometres west of the city and 5 kilometres deep. Extensive damage to buildings, infrastructures, and unfortunately significant loss of life. New Zealand’s second deadliest earthquake on record after the Napier Earthquake in 1933;

- 13 June 2011, 6.0 magnitude aftershock, followed by intense aftershocks ranging from magnitudes 5 to 6; and

- 23 December 2011, 5.9 magnitude aftershock, followed by intense aftershocks ranging from magnitudes 5 to 6.

Across the four events, the Canterbury region suffered extensive infrastructural damages, including collapsed buildings and ruptured utility lines, with losses in excess of NZD$45 billion inflation adjusted.

Kaikoura Earthquake

On 14 November 2016, Culverden, an hour’s drive north of Christchurch, was struck by a 7.8 magnitude earthquake with a depth of 15 kilometres – the second highest magnitude in New Zealand’s history.

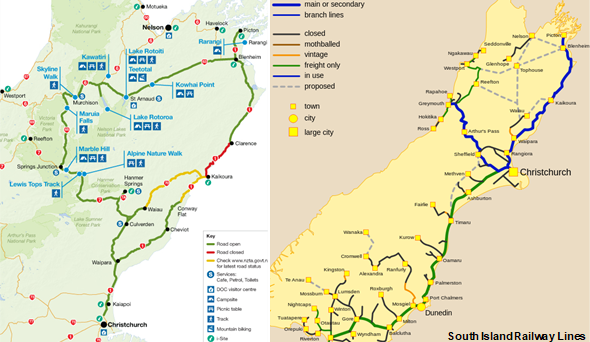

This event led to the immediate closure of key transport routes, including State Highway (“SH”) 1 and the Inland Kaikoura Road, effectively isolating Kaikoura and nearby communities.

The main trunkline railway was severely damaged, and it took approximately a year to restore the rail service to Christchurch, with operations recommencing in September 2017.

Damage was also sustained to buildings and infrastructure throughout the Wellington Region and disrupted operations at the Port of Wellington.

Travellers were forced to take alternate inland routes via SH 63, SH 6, and SH 7 as seen in the image below. Using the longer alternative routes resulted in increased freight and transportation costs, resulting in losses for manufacturing and transport dependent industries.

Insurance Coverage

Earthquakes are known for causing a wide range of damage such as but not limited to structural damage, land movement and erosion, liquefaction, and depending on the circumstances can potentially increase the risk of or contribute to subsidence, volcanic eruptions, and tsunamis.

In part, this may be why Business Interruption resulting from an earthquake event generally falls under Natural Disaster coverage limits, which can be more limited in comparison to other perils.

Despite the propensity of earthquakes to cause a large variety of potential damage, often many businesses sustain no physical damage. Further, due to a range of factors such as changing subsurface topographies, there can be situations where damage is extensive to one structure, but others immediately adjacent remain unscathed – making the risk of damage less predictable.

Businesses unscathed by damage instead may still be impacted by offline utilities, prevention of access, authoritative closures, transport route and port closures, third-party damage, or combinations of these.

In the absence of physical damage to insured property, ordinary Business Interruption insurance will not automatically respond for claimants seeking reparation for lost Gross Profit, Increased Cost of Working, or Extra Expenses.

Many businesses however have Dependency or Contingency Coverage Extensions to cover their dependencies on third parties, utilities, transport routes and ports, and the like. For businesses that did not sustain physical damage, this presented an opportunity to claim for Business Interruption losses directly caused by these contingent perils.

Business Interruption Coverage Issues

The most recent Christchurch and Kaikoura events led to a number of situations affecting businesses, some of which are common to widespread disasters and others more unique to earthquakes.

Notably the development of red zones and exclusion zones by authorities, depopulation, proximity restrictions for closure of transport routes and prevention of access, and proximate cause challenges in the wake of multiple events.

These issues are discussed in further detail below.

Red Zones

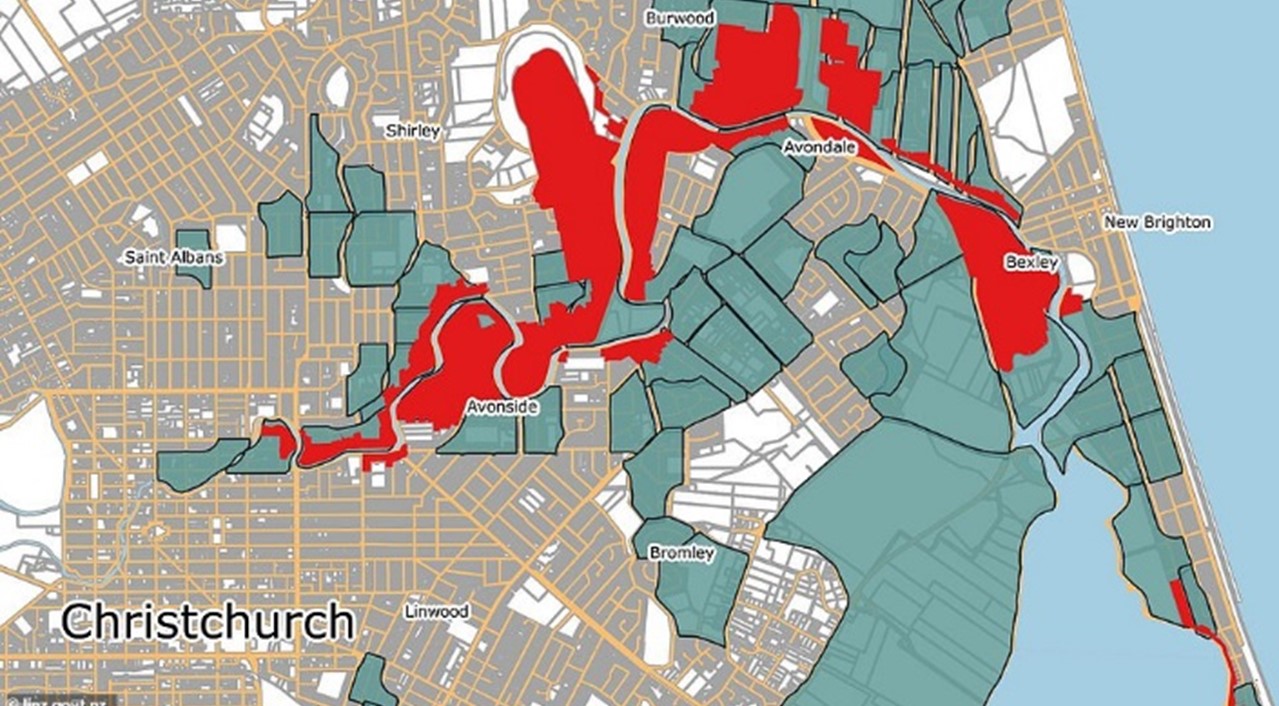

Red zones are areas of land deemed unsuitable to rebuild. This is usually as a result of a Public Authorities intervention to relocate suburbs, towns, or cities largely due to ensuing soil liquefaction.

Where businesses were within these red zones, Business Interruption could trigger either from damage sustained to insured property or through contingent causes such as prevention of access due to closure or evacuation by an Authority.

In the context of businesses that do not sustain damage but are in close proximity to red zones, Business Interruption could trigger through contingent causes such as from damage to a third party, or closure of transport routes forfeited within Red Zones.

The key challenge in this situation is that whilst such a business may be materially interrupted by such contingent causes for the foreseeable future, they are restricted in the length of their maximum indemnity periods, which is typically 12 months.

This was the case in Christchurch in the wake of the 2010 to 2011 earthquakes. Following the expiration of Business Interruption coverage, businesses were still impacted materially due simply to the fact that the mass relocation of people out of red zones nearby caused localised depopulation, left areas perceived as undesirable or unsafe to visit, drastically reduced customer foot traffic and, subsequently, profits.

Exclusion Zones

Exclusion zones enforced by Public Authorities are similar to red zones as areas temporarily excluded to the public. Whilst these zones can be rebuilt in contrast to red zones, the damage within exclusion zones is typically in built up areas. The risks of further structural deterioration and collapse of high rising structures from future ongoing aftershocks leaves the proximate area surrounding these structures a hazardous space to occupy until damage is assessed, structures reinforced or made safe, or in the worst cases, dismantled.

Given that most high rise buildings are concentrated in central business districts of cities, exclusion zones typically caused more widespread interruption to businesses than red zones which often reside over residential areas.

Exclusion zones were used in particular following the second earthquake in Christchurch where a number of large buildings sustained irreparable damage and were a risk to the public due to risk of falling materials, and partial or full collapse.

As a result, businesses located within exclusion zones were unable to operate and other nearby surrounding areas left areas perceived as undesirable or unsafe to visit, drastically reduced customer foot traffic and, subsequently, the performance of their businesses.

Again, where periods of contingent Business Interruption cover expired following a time period, businesses who continue to sustain an interruption to their business would likely be unable to claim the Business Interruption losses on an ongoing basis.

Proximity Restrictions

In some cases, where a contingent Business Interruption arises from prevention of access due to closure by an Authority (earthquake red or exclusion zones), there can be proximity restrictions determined by the proximate radius of a businesses’ insured property to a red or exclusion zone. Sometimes this is limited to just the Insured’s physical business location.

Despite the extensive impact following the second earthquake in Christchurch, for businesses who were subject to a proximity clause and who fell outside the threshold radius, this complicated Claim acceptance under this type of contingent cause.

Prevention of access due to damage or road closure also encounters similar challenges. New Zealand is heavily dependent on state highway infrastructure with limited alternatives such as passenger rail infrastructure (outside of Auckland City). Western, eastern, and northern areas of the South Island for example rely on a couple of key highways, making them susceptible to unusually long detour contingencies or, in some cases, there is no practical detour. Business Impact can therefore be amplified due to an intense dependency on these highways remaining open.

Following the Kaikoura earthquake, SH 1 and the main railway trunk line sustained severe damage, requiring as much as 12 months to reinstate and restore functionality for dependent businesses and the public. These are long passages of road and rail that are well in excess of radius restrictions typically seen between 1 KM to 50 KM. In the scenario where businesses in the Kaikoura area were subject to a proximity clause and fell outside any applicable threshold radius, this may have proved fatal to Claim acceptance under this type of contingent cause.

Depopulation

Depopulation is a common phenomenon following earthquakes. While depopulation contributed to less business activity, customer foot traffic, and local investment in the Christchurch economy, fixed costs such as insurance, rates, and water utilities among others increased materially for businesses that did continue trading.

Similarly to red and exclusion zones, when considering the ongoing performance of the business long term following the period of cover lapsing, businesses may continue to perform worse simply because of reduced population. This added a further complication to the measurement of Business Interruption losses.

In the case of Christchurch, approximately half a decade following the 2010 to 2011 earthquakes, record low property values in the region and the absence of further ongoing significant earthquake events among other variables contributed to a reversal of depopulation. In this scenario, businesses may have conversely seen growth in trading performance which would need to be considered with respect to any new or ongoing Business Interruption claims, whether earthquake related or not.

Proximate Causation

During the Christchurch earthquakes, many businesses were affected by multiple events and often simultaneously including power outages, prevention of access, exclusion zones, port and road closures, and damage to third parties, of which, all could be contributing to a sustained loss of profits.

Most claimants had these extensions to cover losses stemming directly from such dependencies, however, there may have been causes that fell outside the scope of cover and were not insured losses which must be separated. Separating these potential uninsured causes of loss became a significant quantification issue.

Identifying the dominant proximate cause of losses is challenging for Insurers and policy holders alike, and often requires a tailored approach for each case because of, but not limited to the following considerations:

- Different combinations of insured and uninsured loss changing across industries and geographies;

- Varying degrees of impact from earthquakes in both length and severity between regions, suburbs, and even adjacent blocks;

- Different coverage limitations, exclusions, and deductibles across the market;

- Quality of financial information available to substantiate different causes of loss;

- Changing regional economic environment seen over extended periods; and

These contribute to the absence of a one – size – fits – all approach.

Conclusion

Resources to manage the significant claims volumes are tested during earthquake disasters. The intensity of the earthquake and the proximity and depth of the epicentre to commercial civilisation is often a factor that drives higher claims volumes.

The added difficulty of dealing with a large volume of dependency claims arising from earthquakes means that Insurers had to rely very heavily on their panel of accountants to unravel the often tangled knot of multiple causation and then make sure that the correct policy application had been considered. This often included managing the expectations of the brokers and their clients.

As many of these claims were relatively low in value, efficient ways had to be found to deal with them to ensure that client expectations in both time and value delivery were met.

MDD has considerable expertise in dealing with these types of claims and the complexities that may occur in a time-efficient and cost-effective manner using its combination of local representation and regional and international depth of resources.

By Josh Herbert.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

https://riseuprichmond.nz/red-zone-futures-land-maps-and-information/

https://www.britannica.com/event/Christchurch-earthquakes-of-2010-2011

https://www.kiwirail.co.nz/media/first-freight-train-rolls-through-kaikoura/

https://www.transport.govt.nz/assets/Uploads/Report/Kaikoura-Earthquake-MERIT-Report.pdf

https://interactives.stuff.co.nz/2019/09/christchurch-red-zone-to-green/

Kenneth’s guide to the alternative route (Picton to Christchurch)