“May 2024 (Tortola): it’s currently 30 degrees (Celsius) down there…”

I’ve been very fortunate to experience first-hand the beauty of the Caribbean over the past few years, but you could imagine my surprise, when the diving instructor mentioned the above water temperature as we prepared for our final dive to become PADI certified at our max depth of 18-metres.

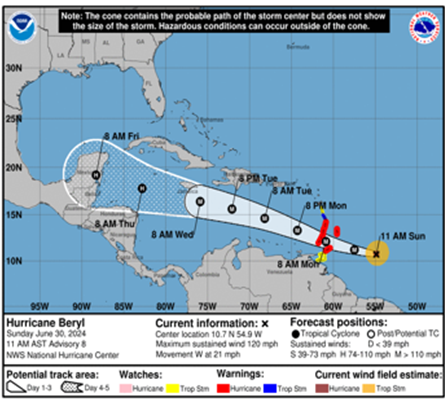

Whilst I’m sure the Northern Hemisphere welcomes summer and some warmer weather, locals (and insurers alike) watch on nervously as Beryl makes its way towards the South Leeward islands.

For those familiar with the chartering industry, the Leeward Islands, such as Grenada, is recognised as a “safe” haven for yachts and catamarans alike during hurricane season. With Beryl expected to make landfall immanently, insurers are keeping a watchful eye.

Beryl: An Unusual Storm

Hurricane Beryl has set the stage for what promises to be an intense hurricane season.

Just like Otis last year, Beryl has already set a formidable precedent with its rapid intensification.

Originating in the warm waters of the Atlantic, Beryl quickly escalated from a tropical storm to what is now expected to be a powerful Cat 4 hurricane.

Arriving earlier than normal (on average the first hurricane arrives by mid-August), Beryl is the perfect reminder of the volatile conditions expected to dominate this season and the destructive potential of these storms.

The Forecast: An Active Season Ahead

Experts predict a particularly active hurricane season this year, driven by several key factors:

- Warm Atlantic Waters: Elevated sea surface temperatures provide more energy for storm formation and intensification.

- Diminishing El Niño Influence: The weakening of El Niño typically correlates with increased hurricane activity in the Atlantic.

- Favorable Atmospheric Conditions: Lower wind shear and conducive atmospheric patterns are expected to support the development and sustenance of more storms.

The outcome, the NOAA forecasts a range of 17 to 25 named storms this year of which 8 to 13 hurricanes, including 4 to 7 major hurricanes (cat 3, 4 or 5).

This represents a +57% increase compared to last year’s predictions, with forecasters having a 70% confidence in these ranges.

The increased likelihood of significant hurricanes poses substantial risks to both individuals and businesses alike.

Implications for the Insurance Industry

The anticipated active hurricane season poses significant risks and challenges for the insurance industry:

- Increased Claims Volume: With more frequent and severe storms, insurers can expect a surge in claims related to property damage, business interruption, and other storm-related losses.

- Financial Strain: The cumulative impact of multiple significant hurricanes can strain financial reserves, requiring robust reinsurance arrangements and risk diversification strategies.

- Underwriting Challenges: Accurately assessing and pricing risk becomes more complex amid heightened uncertainty and potential for widespread damage.

- Operational Readiness: Ensuring that claims processing and customer support systems are prepared to handle a high volume of activity is critical to maintaining service standards and customer trust.

Preparing for the Storms Ahead

For the insurance industry, proactive measures are essential in navigating the dangers posed by the hurricane season and it is essential we:

- **Enhance Risk Assessment Models**: Leveraging advanced data analytics and machine learning to refine predictive models can help in better understanding and mitigating risks associated with severe weather events.

- **Strengthen Financial Resilience**: Ensuring adequate reserves and reinsurance arrangements will be crucial in managing the financial impact of large-scale claims.

- **Improve Customer Communication**: Proactive engagement with policyholders regarding coverage details and emergency preparedness can enhance customer satisfaction and trust.

On a personal note, witnessing the predictions for an active hurricane season underscores the importance of being well-prepared and resilient. For those living in hurricane-prone areas, now is the time to prepare with simple steps such as creating an emergency kit, securing your property, and having an evacuation plan, which can make a significant difference in safety and recovery.

Conclusion

For the insurance industry, the 2024 hurricane season predictions serve as a stark reminder of the volatility of our environment and the importance of preparedness.

By adopting proactive strategies and maintaining robust operational capabilities, insurers can navigate the challenges ahead and continue to support their policyholders through the storms.

As professionals, the impending forecast reminds us of the critical role we play in supporting our clients through challenging times.

As extreme meteorological events become the new “norm”, it is a reminder to all in the insurance sector to innovate, adapt, and strengthen our services to better serve our communities in the face of natural disasters.

But for now, insurers and locals alike will keep a watchful eye on Hurricane Beryl and its forecasted path.

By Samuel Dorie.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

Samuel Dorie

Samuel Dorie