Alternate dispute resolution (ADR) is any procedure that is used in matters that would otherwise be settled in a court of law. Examples of ADR include arbitration, mediation, appraisal, and mini-trial. ADR is a dispute resolution strategy with applications to insurance, reinsurance, commercial contract and/ or labor disputes, estate and divorce actions, and personal injury claims.

ADR procedures generally offer a less emotional, more cooperative approach and allow each side to better understand the other’s position without legal wrangling. When used effectively, ADR is more efficient, takes less time, and is less costly. Experienced arbitrators and mediators can often guide a more creative process tailored to the specifics of the dispute in question.

Role of the Forensic CPA

Historically, forensic CPAs (FAs) participate as experts alongside attorneys, other subject-matter experts, and claim handlers representing either the claimant or respondent in insurance and reinsurance disputes. For the moment, consider how resolving these disputes through ADR might benefit from the experience of a seasoned FA as an arbitrator or mediator.

First, it is not uncommon for FAs, in their role as experts, to represent both claimants and respondents. Having participated on both sides of the table provides FAs with a valuable perspective when discharging their arbitrator or mediator responsibilities.

In addition, FAs bring many other advantages to the dispute resolution process:

- Because they are also certified public accountants (CPAs), FAs have extensive experience analyzing financial statements, operating systems, manufacturing processes, and business operations in general as they delve into the damages, claimed and disputed amounts (‘the quantum’), and supporting accounting details. They are comfortable working with the numbers.

- As CPAs, FAs practice under the Professional Code of Conduct of the American Institute of Certified Public Accountants (AICPA). The code’s standards of objectivity, independence and due care are ingrained into the DNA of FAs. The AICPA code parallels the ethical codes applicable to arbitrators and mediators in its emphasis on integrity, honesty, fairness and competence.

- While technically not viewed as “policy experts on insurance matters,” seasoned FAs nonetheless have considerable experience examining and applying the various types of coverage to claim disputes as they categorize and quantify the loss components into appropriate “coverage buckets.” They understand how coverage works in real-life terms.

- FAs are accustomed to analyzing the deep quantum details, reconciling the claim differences on a line-by-line basis, and presenting their findings to the parties. This can be especially helpful in highly complex claims, such as the case of overlapping covered and excluded physical damage and resulting business income and extra expense losses where a seemingly minor change in one of the variables has an unexpected ripple effect, magnifying the amount of loss.

- As a mediator, an FA is well equipped to help the parties identify and prioritize the dollars associated with issues most important to each side as they attempt to reach a settlement. Similarly, as an arbitrator, the FA is well-positioned to help other panel members evaluate and reach agreement on how a dispute should be resolved.

- FAs who have represented both claimants and respondents bring a level of impartiality and a unique perspective to the mediation or decision-making process.

- Forensic accounting may be generally defined as “the art and science of investigating people and money.” As such, the FA’s investigative skill set includes a keen sense of what’s fact versus fiction as well as what’s reasonable as opposed to speculative.

By Way of Example

What follows is a hypothetical first-party property insurance dispute that illustrates how an FA’s experience and skill set might be used effectively to address some of the challenges that an arbitrator or mediator might face in an ADR proceeding.

Assume that a policyholder incurs a total physical damage loss at its Alabama plant. The plant provides important parts to another of its up-stream assembly plants in Michigan. As the insured scrambles to find an alternate source of supply parts to mitigate its loss exposure, it quickly decides to seize the opportunity to expand and modernize the Alabama plant during the downtime. These decisions trigger policy coverage and quantum measurement issues for both the property damage and time element (business income and extra expense) losses.

Setting aside “like kind” replacement cost issues affecting the amount of property loss, the policyholder’s decision to expand and modify the Alabama plant creates a mix of other coverage and loss measurement issues. One obvious issue is the need to determine a theoretical versus actual peiod of indemnity (POI) to repair and replace the property as it was at the date of loss. A related issue is what and how much are the business income and extra expense components of the losses sustained during the applicable POI.

Faced with these issues, an FA arbitrator or mediator can easily reconcile the major components of the loss in dispute that lead to a more informed resolution. Rather than using some arbitrary approaches such as splitting the difference, the baseball high/low, or another similar “compromise” approach, reconciling the damages with the coverage issues is a pragmatic way to focus on the real dollar differences and provide a framework in which each side’s position can be prioritized or ranked from strongest to weakest. The FA mediator can facilitate the parties in their attempt to reach and agree upon a settlement; likewise, an FA arbitrator is well-positioned to reach an informed and principle-based decision.

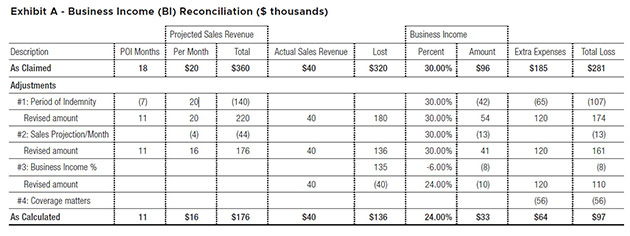

Refer to Exhibit A above to see what a reconciliation in the case of the above time element loss hypothetical might look like. The analysis begins by identifying all the major as-claimed categories across the top of a spreadsheet. The next steps are designed to allow only one adjustment at a time to account for each major difference until one reaches the as-calculated amount detailed at the bottom of the spreadsheet.

Now let’s walk through Exhibit A above and further discuss how a basic time element/business income reconciliation works. For purposes of this hypothetical, assume the policyholder has made a business income (BI) claim based on an 18-month period of indemnity (POI) and has claimed $96,000 in BI and another $185,000 in extra expenses (EE) for a total claimed amount of $281,000. Major differences between the parties are illustrated as adjustments 1 through 4 below:

- #1: Period of Indemnity. There is a difference of seven months between the time it took for the insured to expand and modernize the Alabama plant as opposed to the theoretical period of indemnity it should have taken to repair and replace the plant as it was at the time of loss with due diligence and dispatch. Therefore, the amount of BI/ EE loss solely attributable to this time factor is a $107,000 difference.

- #2 Projected monthly sales revenue. Based on some differences in trending methods and an error in calculation, the insurer’s position is that expected monthly sales revenues had no loss occurred would have been $16,000. This adjustment results in a $13,000 difference on a stand-alone basis.

- #3 Business income (BI) percentage. The parties could not agree on the appropriate BI gross-earnings-less-non-continuing-expenses percentage to be applied to the amount of lost sales revenue. This adjustment creates an $8,000 difference, again on a stand-alone basis.

- #4 Coverage matters. Due to some differences in coverage, the parties could not resolve this area. This adjustment results in a straightforward difference of $56,000.

The FA and the parties can now identify how many dollars are associated with each of the major differences in the dispute. The panel can then prioritize based on the perceived strengths and weaknesses of each party’s position as they move toward a more informed resolution of the dispute.

No Strangers to Coverage

Matching the right mediator or arbitrator to the specific facts and issues in dispute is crucial to a successful ADR outcome. Adding an FA to the potential pool of candidates introduces a different perspective and set of skills that should not be overlooked. FAs are no strangers to coverage; in fact, they often have a better appreciation of the real-life impact because of their ability to quantify the financial loss by varying the coverage equation. They are comfortable working with financial concepts and numbers and are accustomed to devising reconciliation tools that can be used to simplify complex disputes, thus leading to a fair ADR resolution.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.